Update: This post has been updated with new scoring and winners based on changes or upgrades to some of the products and services. Read on to see our winners for the best online rent payment service for 2025:

Property management software can be a useful tool for small and independent landlords to run their businesses effectively. We’ve written overviews of many top software products that offer solutions for a variety of standard property management tasks—from advertising and applications to tenant screening, lease signing, and rent collection.

Here we compare how each of these software programs handles online rent payment from a landlord’s perspective. We compare them across a variety of factors and then determine the best online rent payment service for small landlords.

The Best Online Rent Payment Service – Our Top Picks

We considered the following rental property management software products for the best online rent payment service. Read below for our complete criteria for what you should look for when choosing the best rent collection apps and tools for you:

-

PayRent –

Winner: Best Service For Landlords Focused on Collecting Rent

Winner: Best Service For Landlords Focused on Collecting Rent -

Avail –

Winner: Best Rent Payment Service with Complete Property Management Features

Winner: Best Rent Payment Service with Complete Property Management Features -

TurboTenant –

Winner: All-in-one Rental Property Management Platform with Integrated Education and Comprehensive Lease Document Handling

Winner: All-in-one Rental Property Management Platform with Integrated Education and Comprehensive Lease Document Handling -

Hemlane –

Winner: Best Hybrid Property Management Platform

Winner: Best Hybrid Property Management Platform -

Baselane –

Winner: Best for Integrating Rent Collection with High Interest Landlord Banking

Winner: Best for Integrating Rent Collection with High Interest Landlord Banking -

Stessa –

Winner: Best Portfolio Management and Accounting Software for Landlords

Winner: Best Portfolio Management and Accounting Software for Landlords - RentRedi – Complete Property Management App, Great for Landlords and Tenants on the Move

- DoorLoop – Rental Property Management Software Made Easy, Scalable for Large Portfolios

Our Criteria for Choosing the Best Rent Payment Service

Below are the 5 key rent collection features to consider when choosing the right tool for your properties. We also include a bonus feature that your tenants may find useful.

- Payment Options

- Automated/Recurring Rent Payments

- Speed

- Fees/Cost

- Bookkeeping and Accounting

- Bonus: Credit Agency Reporting

Collect Rent Online: The Best Rent Payment Systems

Each of these systems has features that let landlords collect rent online. Choosing the best online rent payment service for you depends on a variety of factors that are most important to you.

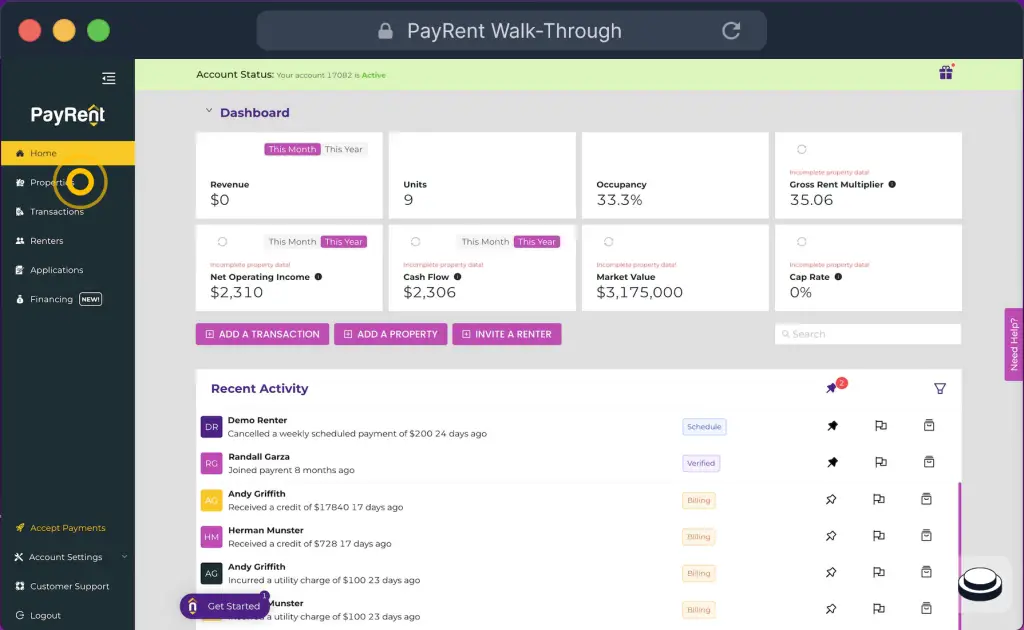

1. PayRent

Winner: Best Overall Online Rent Payment Service

- 3 different subscription plans starting at $0 per month allow you to choose the right set of features for your portfolio.

- Tenants can set up recurring payments so you know your rent will be paid no matter where they are or how busy they may be.

- Free credit reporting rewards renters for their largest monthly expense and encourages consistent on-time rent payments so you get paid.

- Strength: Rent Collection

What We Like About the Company

- PayRent is dedicated exclusively to online rent collection.

- There’s a free version that allows unlimited units and only charges for optional services.

- Tenants can opt into Rent Reporting, which notifies the credit bureaus of on-time rent payments, provides an incentive for on-time payments, and offers the opportunity for renters to build their credit.

➤ Read our review or sign up here.

PayRent is a product that focuses solely on online rent payment for landlords like us. With multiple plans starting at $0/month, landlords have access to a low-cost solution for collecting rent payments. Choose to pass transaction fees on to your tenants, and your rent payment fees could be $0. Tenants will also receive rent reminders and can schedule automated payments in advance, helping to ensure on-time rent collection every month.

Additionally, PayRent offers a RentDefense feature with their paid packages: Payment controls and rent collection enforcement that help you collect rent with less hassle and stress, and virtually eliminate late and lost rent. Landlords can also upgrade to a premium plan that promises 3-day express funding and free bank transfers.

Payment Options: Your tenants can choose eCheck, a type of ACH transfer, or credit card payment methods. Add your tenants to the platform, and PayRent will send out an email invitation for them to join the service, then help them through the process of adding a payment method.

Recurring Payments: Working late or going on vacation shouldn’t stop your tenants from making their online rent payment on time. Let them set up a one-time future payment, or weekly, semi-monthly, or monthly recurring payments, so you know your rent will be paid no matter where they are or how busy they may be.

Speed: PayRent can deposit your rent payments to any bank with branches in the U.S., with a 5-day hold for users on the Pay-As-You-Go and DIY plans. This is expedited to a 3-day hold for their premium Go-Like-A-Pro subscribers.

Cost: PayRent offers 3 different plans. The free Pay-As-You-Go plan costs $6 per ACH transfer and has a $10 activation fee. The DIY plan costs $24 per month with $5 ACH transfers. And the Go-Like-A-Pro plan gives you free ACH transactions for a monthly subscription of $59.

Bookkeeping & Accounting: PayRent sends automated rent reminders to your renters, which helps avoid last-minute confusion and stress. You will also receive instant email notification when rent is paid, as well as accounting and tracking of rent payments. There do not seem to be other financial reporting features that some of the other services offer.

Credit Agency Reporting: Landlords using PayRent to collect rent can use the credit reporting system to report rent payments to Equifax, Experian, and TransUnion. It reports both on-time payments and late payments for free.

If what you need is fast, secure, reliable online rent collection, PayRent is for you. It’s our overall winner for the Best Online Rent Payment Service.

Get Started with PayRent for Free.

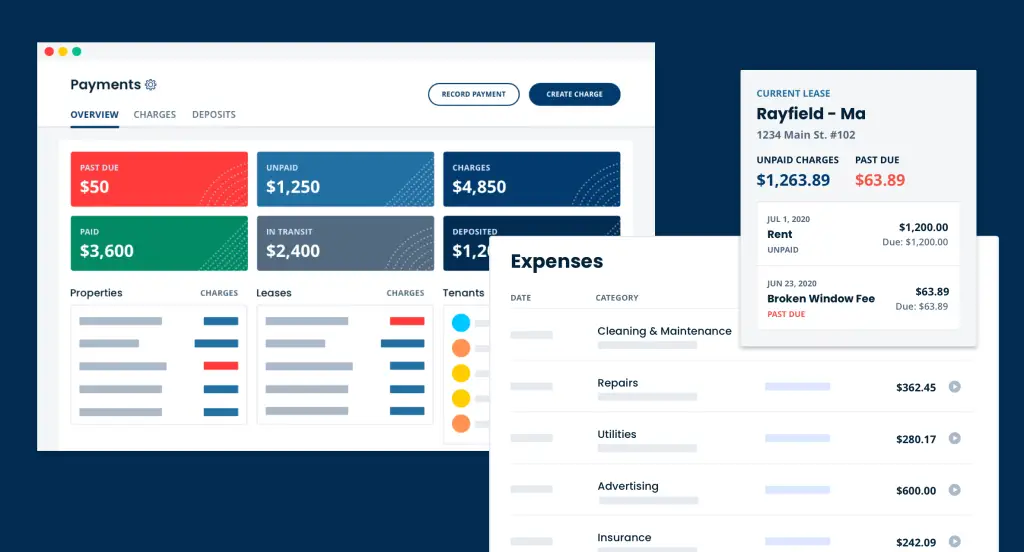

2. Avail

Winner: Best Rent Payment Service with Complete Property Management Features

- 2 subscription plans: $0 for Unlimited or $5/month per unit for Unlimited Plus

- Tenants can pay rent with a credit card or checking account, or use Autopay, which automatically withdraws the funds from their account each month.

- Rent payments deposit directly to your linked bank account in just three business days – less time than processing a paper check or visiting your local bank.

- With a subscription to Avail’s Unlimited Plus premium plan, next day “FastPay” payments are available to landlords at no additional cost.

- Strength: Complete Solution

What We Like About the Company

- It’s a comprehensive property management platform with features that go way beyond online rent collection. It includes listing syndication, tenant screening, maintenance tracking, digital leases, and more.

- Avail’s Unlimited plan is free and comes with most of the platform’s features, including online rent collection.

- The company offers custom rental analysis reports to help you set competitive rent prices and stay ahead of market changes.

➤ Read our review or sign up here.

Avail is a full-featured property management platform that lets small landlords:

- Syndicate listings

- Accept rental applications

- Screen tenants

- Manage digital leases

- Collect rent online

- Track maintenance requests

- Analyze rental markets

- Complete rental property accounting

Avail is our winner for best online rent payment service in the property management software category. With 1-3 day FastPay ACH transfers included for Unlimited Plus subscribers and 4-7 day deposit times for all others, Avail offers a fast and convenient rent payment service. Furthermore, landlords do not need to be paid subscribers to access Avail’s online rent payment service. At $2.50 per transfer that your tenant can pay, a landlord can collect rent at no additional cost.

Payment Options: Tenants can pay from their bank accounts or with credit cards. They can also pay from any device that has internet access. Getting started is simple: Enter the rent amount, lease dates, your tenant’s name and email, and Avail will handle the rest.

Recurring Payments: Tenants can turn on autopay to schedule recurring online rent payments. They simply choose a date to withdraw the funds, and Avail will deposit the funds directly into your account. Landlords can also manually add custom payment dates if they want to create an installment schedule for their tenants.

Speed: Payments typically deposit directly to your bank in 4-7 business days, faster than a check and without the hassle of a trip to the bank. With a subscription to Avail’s Unlimited Plus plan, 1-3 day “FastPay” payments are available to landlords at no additional cost.

Cost: Using Avail’s free Unlimited plan, ACH transfers cost $2.50 per transaction. With the premium Unlimited Plus plan, landlords receive free ACH transfers. And under either plan, credit and debit card transactions are charged a 3.5% transaction fee.

Bookkeeping & Accounting: Avail offers automatic reminder emails and built-in payment receipts. Late fees can be automatically assessed as well. Landlords have access to payment tracking and reporting. For example, Avail syncs rent payments and any maintenance expenses reported on Avail so you can stay on top of bookkeeping. Transactions collected outside Avail can be added manually. Plus, Avail issues 1099-K forms each year to help you prepare for tax season.

Credit Agency Reporting: Avail can report your tenants’ on-time rent payments to Transunion with their CreditBoost service. Your tenants may see up to a 40-point increase in their credit score as a result.

What makes Avail a winner is their best-in-class property management software solution. In addition to online rent collection features, a subscription to Avail gives you all the tools, guidance, and educational content you need to be a confident and professional landlord.

3. TurboTenant

Winner: All-in-one Rental Property Management Platform with Integrated Education and Comprehensive Lease Document Handling

- Landlord software that simplifies how you self-manage your rental business.

- Set up automatic late fees or turn on automatic payments for your tenants with email reminders and automated technology,

- Comprehensive payments dashboard and integrated accounting software provides a full view into your income and expenses

- Strength: Complete Solution

What We Like About the Company

- TurboTenant has a free plan that includes most of its features, including online rent payments, autopay, and automatic late fees, receipts, and reminders.

- Through its partner REI Hub, TurboTenant offers comprehensive accounting features for your property management business.

- As an add-on feature offered through a partnership with Lula, landlords can choose to outsource property maintenance.

- Compared to other platforms, TurboTenant’s $2 ACH fee for the Free and Pro plans is relatively low.

➤ Read our review or sign up here.

TurboTenant is online property management software that empowers independent landlords to:

- Advertise vacant units

- Track leads automatically

- Accept online applications

- Screen tenants

- Create lease agreements

- Collect rent

- Add-on: Complete rental property accounting

- Add-on: Outsourced property maintenance

TurboTenant’s secure rent collection tool was created exclusively to meet landlords’ needs. Renters and landlords alike don’t have to worry about security when it comes to TurboTenant since they partner with industry leaders Stripe and Plaid to ensure everyone’s information stays safe.

Payment Options: Tenants can pay via ACH or credit/debit card.

Recurring Payments: Landlords can set up automatic late fees or turn on automatic payments for their tenants. With email reminders and automated technology, forgetful tenants are prompted to pay on time. And if they don’t, TurboTenant will let you know.

Speed: On average, ACH Payments take 5-7 business days to be deposited into your bank. TurboTenanat offers expedited ACH processing with their premium subscription plan, decreasing the time to approximately 2-4 business days.

Cost: TurboTenant offers three subscription plans. Under the Free plan, landlords have access to autopay, automatic late fees, rent reporting, and a payments dashboard. However, there’s a $2 ACH transfer fee (that you can pass on to tenants). Under the Pro plan, rent payouts are expedited, and under the Premium plan, the ACH fee is waived. Tenants incur a 3.49% convenience fee under all plans if they pay with a credit/debit card.

Bookkeeping & Accounting: TurboTenant’s payments dashboard makes it easy to understand which tenants are completely paid up vs. those who owe money (and how much). It also shows how property expenses stack up against rent payments on an annual basis. Additionally, TurboTenant’s recent integration with REI Hub was tailor-made for landlords and their accounts. Rent collection data flows automatically into REI Hub’s system, meaning landlords can get straight to the reports they need faster than ever, for just $9/month (billed annually) for the first three units (and more after that). Regardless of the number of units, users will not pay more than $48/month (billed annually) for this extraordinary tool.

Credit Agency Reporting: TurboTenant offers rent reporting to build tenants’ credit history when they pay rent online. Once rent reporting is activated by the tenant, TurboTenant will automatically report your tenants’ on-time rent payments to TransUnion for free, helping them improve their credit scores.

Collect Rent Online – Sign Up for TurboTenant Free

4. Hemlane

Winner: Best Hybrid Property Management Platform

- Hemlane is a next-gen property management tool that bridges the gap between DIY and full service property management.

- 3 packages: Basic, Essential, and Complete, starting at $28 per month + $2 per unit, so you can decide how much service you require from Hemlane

- There are no ACH transaction or set-up fees with a subscription to any of Hemlane’s plans.

- ACH payment processing generally takes 3 business days for paying customers with verified accounts.

- Strength: Hybrid Full-Service Mgmt

What We Like About the Company

- On top of streamlining rent collection, Hemlane offers all of the services of a traditional property management company if you want to step back from daily operations, so you can make your rentals a totally passive investment.

- Hemlane provides a lot of flexibility in what payment options you accept, how you request rent, and how tenants schedule rent payments.

- There’s a 14-day free trial for you to try out all of Hemlane’s features, and you won’t be asked for payment information until after the trial ends.

➤ Read our review or sign up here.

Hemlane is a property management platform that helps property owners manage their rentals wherever they are. It’s a cross between DIY and full-service management that automates day-to-day administration, from advertising vacant properties to collecting rent and late fees. Because it lets landlords choose how much control of day-to-day operations they retain, Hemlane is our winner for the best hybrid property management platform.

For landlords who want complete freedom from the daily operations of their rentals, Hemlane can connect you with local, in-person leasing agents and service professionals with 24/7 repair coordination. Alternatively, you can maintain control with Hemlane’s automations and all-in-one platform for leasing and management. Or select something in between, where you have access to Hemlane’s software plus repair coordination to allow you to sleep through the night without being woken up with a late-night emergency.

Payment Options: Landlords can let tenants pay rent with a bank account only, or give them the option to pay with a bank account, credit card, or debit card. Landlords can choose to pay the 3% credit card transaction fee themselves or pass it directly to the tenant.

Recurring Payments: Hemlane allows owners to request payments using online or offline payment requests. These requests can be configured for a one-time request (such as a security deposit) or a recurring request (such as monthly rent). Tenants can then set up automatic payments for any recurring request. Hemlane provides flexibility to schedule for the due date or a prior date.

Speed: Hemlane’s ACH payment processing generally takes 3 business days for paying customers with verified accounts. However, first transfers and free trial user payments generally take 5 business days and could take up to 10 to address risk.

Cost: There are no ACH transaction or set-up fees with a subscription to any of Hemlane’s three paid plans. The Basic plan starts at $30/month and comes with all of Hemlane’s rent collection features, including late fees and financial tracking. In contrast, the free plan doesn’t include any online rent payment features.

Bookkeeping & Accounting: Payments are automatically recorded into Hemlane’s robust financial reporting dashboard, so you never lose track of payment records and receipts. Hemlane will automatically send requests for late fees, whether one-time or daily late fees, per the lease details. Hemlane also requires late fees to be paid prior to the rent, where allowed.

No matter which paid package you choose, Hemlane offers landlords access to its robust online rent collection and financial tracking tools.

5. Baselane

Winner: Best for Integrating Rent Collection with High-Interest Landlord Banking

- Integrated set of property management tools to help real estate investors and landlords save time and money while increasing their rental property returns.

- One platform for all your property banking & finances. 100% free.

- Tenants can pay by ACH bank transfer or debit/credit card, and can easily enroll in auto-pay.

- Payments are deposited directly into your bank account in as fast as 2 days.

- Strength: Landlord Banking

What We Like About the Company

- With Baselane, you can handle rent collection, banking, and accounting on a single platform, simplifying your rental business’s finances. You can even connect Baselane with external bank accounts and credit cards and take advantage of QuickBooks-like accounting features.

- Baselane doesn’t have account opening fees, monthly account fees, minimum balance fees, inactive account fees, return payment or overdraft fees, or ACH transfer fees.

- You can earn money on any rental income sitting in your account with Baselane’s 3.35% APY (60x the national average).

➤ Read our review or sign up here.

Baselane is a rental property management tool that helps landlords and real estate investors save time and money while increasing their rental property returns.

Along with having one of the best bank account options for landlords, Baselane offers debit cards with smart controls that allow cardholders to control and manage their expenses. You can also integrate it with your bookkeeping, reporting, analytics, and rent collection tools.

Payment Options: Baselane provides tenants a platform to pay rent on any device. Simply set up your lease, invite your tenants, and get paid. Tenants can pay by ACH bank transfer or debit/credit card, and can easily enroll in autopay.

Recurring Payments: Tenants can turn on autopay to schedule recurring online rent payments or get reminders when rent is due to avoid late fees.

Speed: Payments are deposited directly into your bank account, sometimes as fast as 2 days. You will also receive automated alerts once rent is paid.

Cost: ACH payments are free for both landlords and tenants if you use Baselane as your bank account. If you deposit ACH transfers to an external account, there’s a $2 transaction fee. For debit and credit card payments, there’s a 3.49% fee.

Bookkeeping & Accounting: Baselane offers automated payment notifications, reminders, history, tracking, and late fee settings. You can also integrate a Baselane banking account, external accounts, and credit cards to manage your landlord finances in one place.

Baselane is currently offering a $150 bonus:

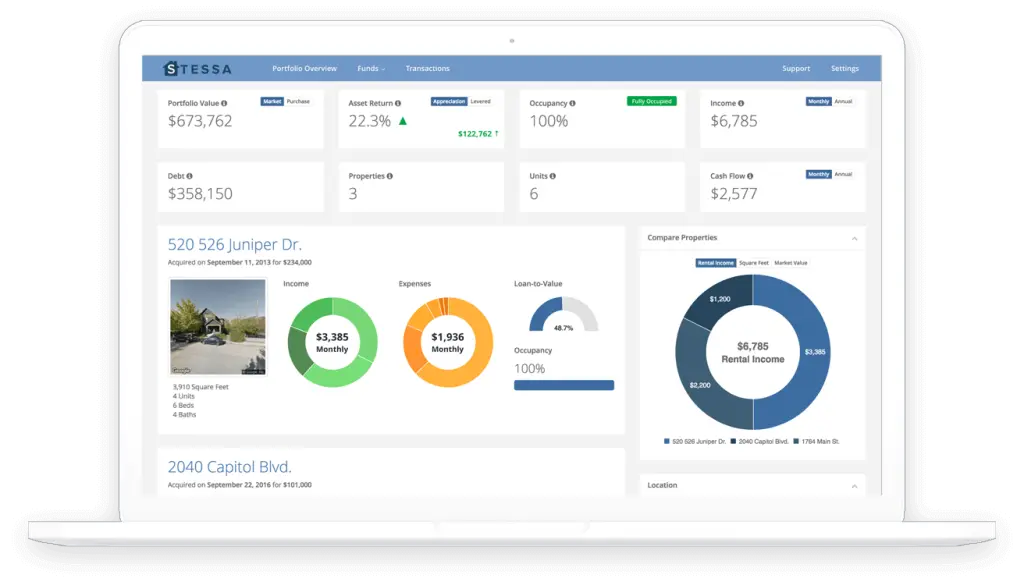

6. Stessa

Winner: Best Portfolio Management and Accounting Software for Landlords

- Free asset management and accounting software for real estate investors, including smart money management, automated income and expense tracking, personalized reporting and more.

- Once you open a Cash Management account, onboard your tenants in minutes. Set up the balance due and your tenant is sent an email invitation to start paying rent through Stessa.

- Offer tenants the ability to set up recurring ACH payments so they never miss a deadline.

- Strength: Accounting and Financial Tracking

What We Like About the Company

- All of Stessa’s online rent collection features are available for free.

- You can also open a free Stessa checking account with a 2.31% APY to keep your landlord banking and accounting in one place.

- Depending on what plan you choose, Stessa comes with various accounting features, including smart receipt scanning, expense tracking, and connecting external bank accounts and credit cards to automatically import and categorize financial data.

➤ Read our review or sign up here.

Stessa is a smart money management platform that helps landlords and real estate investors optimize their portfolios for performance. You can easily collect rent online and automatically integrate payments into your income and expense tracking, personalized reporting, and more.

Stessa has also recently introduced all-in-one money management with a Stessa Checking account, making it even easier to integrate banking with your online rent collection and other property management tools.

You must set up a Stessa cash management account to collect rent. You will also need an active lease and your tenant’s email address. Set up the balance due, and they will send your tenant an email invitation to start paying rent through Stessa.

Payment Options: Tenants can pay through ACH payments with no additional fees. Credit card payments are not supported at this time.

Recurring Payments: Tenants have the option to make a one-time payment or set up recurring payments. Stessa will automatically send a reminder email to your tenant every month, 10 days in advance of the rent payment due date. Another payment request will go out on the due date, showing the current balance due alongside a link to make the payment.

Speed: As a landlord, you can expect to see funds available in your Stessa checking account within 3-5 business days.

Cost: Stessa is 100% free, as are ACH rent payments. However, you get accelerated rent payments with the paid Manage and Pro plans, which respectively cost $12 and $28 per month (billed annually).

Bookkeeping & Accounting: Stessa makes it easy to keep track of property performance, finances, and the paper trail that comes with real estate investing, all in one place. Stessa also automatically sends reminders and deposit notices so nothing slips through the cracks.

Sign Up For a Free Stessa Account

7. RentRedi

Complete Property Management App, Great for Landlords and Tenants on the Move

- One dashboard to manage your rentals, receive payments, screen applicants, manage maintenance requests, and list properties

- Add payment accounts to each property to start collecting & tracking rent

- Receive funds from tenants in as quick as 4-5 business days

- Strength: Complete Solution

What We Like About the Company

- RentRedi is one of the few platforms that accepts cash payments through its partner Chime, and the money still lands in your bank account electronically.

- RentRedi was built to streamline communication between tenants and landlords.

- Nearly all of RentRedi’s landlord features are accessible through the platform’s dedicated mobile app, making it easy to work on the go.

➤ Read our review or sign up here.

RentRedi is a landlord-tenant app that allows you to manage vacancies, screen tenants, and collect payment from wherever you are, on any device. RentRedi’s mobile deposit feature makes it easy for tenants to pay their monthly rent on time. Plus, there’s an option for automatic payments that will also send rent reminders. If a tenant falls behind on rent, they will incur an automatic late fee with a recurring fee amount.

Payment Options: RentRedi allows payment from a banking account (ACH) or credit card. They also allow tenants the option of depositing cash at over 90,000 retail locations through RentRedi’s partnership with Chime.

Recurring Payments: Tenants can choose to enable autopay and schedule recurring rent payments for the same date each month.

Speed: Landlords will usually receive payment from tenants in 2-3 business days after payment account approval.

Cost: Tenants pay a $1.00 processing fee for ACH payments and a 3.1% plus $0.30 fee for credit card payments. However, you can also opt to cover these fees for them. Landlords must also pay a subscription starting at $12/month for the Standard plan.

Bookkeeping & Accounting: RentRedi lets you set up automatic late fees and directly export rent payments to spreadsheets or QuickBooks Online. You can also send in-app notifications by unit, property, or to all tenants.Credit Agency Reporting: With RentRedi, you can reward and encourage on-time rent payments with their credit boost feature, which reports rent to credit bureaus.

8. DoorLoop

Rental Property Management Software Made Easy, Scalable for Large Portfolios

- Powerful and easy-to-use property management software to help manage and grow your portfolio from anywhere.

- Automate everything from listing units to moving out tenants, and everything in between. Automate rent and renewals and reduce turnover.

- Get support by phone, email, chat, or even a video call. With your own account manager, get unlimited free training and onboarding.

- Tenants pay $1.99 fee per ACH payment or 2.95% for credit card payments.

- Strength: Complete Solution

What We Like About the Company

- DoorLoop is ideal for larger portfolios, including residential, commercial, community association, and affordable housing portfolios.

- It also has a dedicated owner portal, allowing you to outsource management to a property manager while still getting detailed insights into your rentals’ performance.

- DoorLoop includes a full customer relationship management (CRM) system for keeping track of leads and tenants from one place.

- You can create unlimited accounts for vendors at no extra cost to streamline communication and maintenance coordination.

➤ Read our review or sign up here.

DoorLoop is a powerful, all-in-one property management software that is easy to use and stands out from many of the other options on the market. It offers unlimited support, full-scale accounting functionality, and a complete suite of useful features: listing, leasing, rent collection, maintenance, tenant communication, and more. This is a fantastic option for landlords looking to streamline their workloads, save time, and grow their business.

Online payments are secured with 256-bit military-grade encryption. Your tenants’ rent payments are encrypted and secured with PCI compliance as they are submitted directly to the credit card processor and never pass through DoorLoop’s servers. Furthermore, you never need to share your account or routing number. Your tenants will fill out a form online with their credit card or bank details, authorizing you to automatically charge them for rent.

Payment Options: You can get paid automatically on DoorLoop via credit card, debit card, and ACH using RapidRent, powered by Stripe.

Recurring Payments: Send automated payment reminders to your tenants before rent is due so that you always get paid on time.

Speed: For security and fraud prevention, your first payment will be deposited into your bank account after 10 business days. After that initial payment, any future credit card or ACH payments normally take 3-4 business days to enter your bank account.

Cost: There is a one-time, non-refundable $49 fee per bank account to start accepting online payments, which covers the cost of application processing, underwriting, and account setup. You will not be charged if your merchant application is denied. Tenants are charged a 3.25% fee for online debit or credit card payments, or a flat fee of $2.49 for ACH payments (or $0.99 if you are a Pro member or $0 if you are a Premium member).

Bookkeeping & Accounting: Late fees are added to every lease automatically at intervals and deadlines of your choosing. See how much each tenant paid or owes instantly. DoorLoop will send alerts automatically about uncollected payments, upcoming lease renewals, and more.

Sign up for a demo of DoorLoop and get 30% off your first three months.

Choosing the Best Online Rent Payment Service: Things to Consider

These are the 5 key rent collection features we considered when determining our top online rent payment service recommendations. We also include a bonus feature that your tenants may find useful. When looking for the rent collection software that is best suited for you, take a look at how each service handles the following tasks.

Payment Options

When choosing an online rent payment service, consider the availability and variety of rent payment options. These include both online and offline options. More options mean flexibility for tenants, helping them get their rent paid on time.

Automated/Recurring Rent Payments:

Look at whether the online rent payment service offers tenants the ability to schedule recurring rent payments each month and how flexible the payment dates are. For example, does the payment occur only on the 1st of each month, or can landlords and tenants schedule different dates? And can the tenant schedule multiple payments each month? This helps ensure tenants pay rent before spending their paychecks elsewhere.

Speed:

Obviously, faster is better when it comes to receiving rent payments, so we compared the time it takes for the landlord to receive their online rent payment. We also checked if there is an option to expedite payments. All of the best online rent payment services claim that most rent payments clear and deposit into your bank accounts within 3 days or so, but there is some variation.

Fees/Cost:

You will also want to check the fees each online rent payment service charges under their free or most basic plans. It can be difficult to do an “apples-to-apples” comparison across rent collection services. However, whenever possible, try to factor prices of subscription plans into a cost per transaction based on the number of units and payment transactions in your portfolio. Additionally, take note where a monthly subscription is required to collect rent online, i.e., no free options.

![]() Related: Best Free Property Management Software for Small Landlords

Related: Best Free Property Management Software for Small Landlords

Bookkeeping and Accounting:

While all of the property management software solutions offer at least some integration of rent payments into their accounting and reporting tools, some have more robust functionality than others. Which of these more advanced features are included in the software? Do they have the ability to track payments and integrate receipts into accounting or reporting? Do tenants receive reminders for upcoming rent payments, and are landlords notified if rent is late or missing? The answers to these questions help determine the best online rent payment service

![]() Related: Best Accounting Software for Landlords

Related: Best Accounting Software for Landlords

Bonus: Credit Agency Reporting:

Does the online rent payment service report payments (and missed payments) to the credit bureaus, such as TransUnion and Experian? This feature can incentivize tenants to make payments on time while improving their credit scores.

![]() Related: Benefits Of Reporting Rent Payments To Credit Bureaus For Landlords

Related: Benefits Of Reporting Rent Payments To Credit Bureaus For Landlords

Takeaway

We have reviewed many of the top online rent payment services that can meet the needs of independent landlords, no matter the number of properties you manage. While some services are part of a property management software product that includes a variety of features, others may only offer rent collection if that is most important to you. We encourage you to take a close look at the above selections for the best online rent payment service. You can also check out our landlord toolkit to see which ones we have in our arsenal.

Video Extra – Collecting Rent Online:

Read the transcript.

Disclosure: Some of the links in this post are affiliate links and Landlord Gurus may earn a commission. Our mission remains to provide valuable resources and information that helps landlords manage their rental properties efficiently and profitably. We link to these companies and their products because of their quality, not because of the commission.

Cozy is also a good addition in collecting rents online. Also, for the one feature which no one offers but spark rental is Pay check deduction.

Another online payment software is Innago, even our tenants say it’s easier to use than Avail.co.