This is the Landlord Gurus definitive guide to online rent collection for landlords. Stop waiting for rent checks to arrive in the mail. No more filling out deposit slips at the bank. Get your rent deposited directly into your bank account – on time, in full, every month. If you want to collect rent online, read on!

Table of Contents

Introduction

Property management software can be a useful tool for small and independent landlords to effectively run their businesses.

We have written product overviews of several top software products. Each offer solutions for a variety of standard property management tasks. These include advertising and applications, tenant screening, lease signing and rent collection, and more.

In this complete guide to online rent collection, you will first learn the benefits of collecting rent online. Additionally, we discuss why it is safe to do so. We also walk you through how to collect rent online and introduce several of the common online rent collection tools available to landlords. And we present a detailed analysis of several of the top online rent payment services that make it easy for you to collect rent online.

Here we compare how each of them handle online rent collection from a landlord’s perspective. We compare them across a variety of factors and then determine the best online rent payment service for small landlords. We hope you will understand the benefits of online rent collection and can begin to collect rent online right away.

The Benefits of Online Rent Collection

Technology is constantly progressing to where managing daily tasks is moving online more and more each day. That’s no different when it comes to collecting rent on your rental properties each month.

There are many reasons utilizing an online rent payment service might be beneficial to you. Factors such as safety, security, and documentation make online rent collection a great way to protect yourself and your investment.

Time and Labor Savings

One of the more compelling reasons for busy landlords to collect rent online is the time and labor savings you can achieve. Time spent at your rental can be better used to inspect and maintain the property and improve relationships with your tenants rather than tracking down rent checks.

And instead of logging each received payment into a ledger or spreadsheet and then going to the bank to make a deposit, you can focus on other aspects of your rental property business to increase efficiency and profitability.

Dangers of handling cash

Accepting rent in cash is problematic. It cannot be documented, can be lost, and can easily be stolen if someone catches on to your pattern.

No more missed rent payments

Tenants no longer need to remember to write a rent check. Many of these apps allow residents to set up automatic, recurring rent payments. As a result, you can be confident that rent will deposit directly into your bank account on time, in the correct amount (you can even include utility charge-backs and other fees), every single month.

This has become invaluable in helping to eliminate late and missed rent payments.

Forget about billing for late fees, bounced checks, and constantly reminding tenants when rent is due. Automated rent collection software will do all those tasks for you.

Integrate online rent collection and accounting

On top of the time and labor savings, online rent collection allows landlords to integrate income receipts directly into their bookkeeping and accounting tools.

Most rent payment systems show records of rent paid as well as rent that is late or outstanding. Other common features will include automatic late fees, payment status notifications and ongoing payment history.

More robust rent collection tools can also sync to your bank accounts as well as provide income statements, cash flow, rent rolls, rental property metrics, and even tax worksheets and reports.

Experienced investors know that this kind of transparency into their portfolios helps make better decisions regarding their rental property assets.

Are Online Rent Collection Services Safe?

At the end of the day, financial security is the most important thing. This relates to safe online rent payment transactions as well as keeping yourself safe from potential online threats. If you choose to collect rent online, you want to use a rent payment service that will protect your security.

With an online rent collection service, you’re less likely to fall victim to somebody that’s trying to scam you. You also remove the opportunity for major disputes. When somebody doesn’t pay, you have proof that you never received their rent.

Most online rent payment services will collect rent from a person’s bank account before they deposit it to yours. This ensures they have the funds to pay and helps you avoid half-payments with cash or checks that may bounce. Online rent collection makes things more convenient and provide safety for both the landlord and tenants. Both parties are able to see balances and make transactions from a computer or mobile device.

Many renters even prefer making their rent payments online because it allows them to treat it like any other bill. With the best online rent payment services, tenants can even automatically schedule recurring rent payments every month. No more collecting rent payment in person, planning around work schedules, or worrying about lost checks in the mail.

Plus, it helps provide documentation of payments for all parties involved.

Other Benefits of Online Rent Collection

While you’re contemplating the benefits of using property management software to collect rent online, here are a few other perks that make it worthwhile.

- Different management software will allow you to set up monthly reminders when rent is due. This can notify your tenants to make sure they have their accounts funded before the due date.

- These services speed up the process of getting your deposits. You don’t have to look for tenants, and you can get the money directly deposited into your account.

- You can more reliably evict tenants when needed by having a record of missed rental payments. This works well for keeping up with records and invoices. It removes the lack of documentation that comes with accepting cash.

- Landlords are able to require tenants to buy renter’s insurance. In some cases, they can purchase it directly through the site.

- Most services provide listing syndication where vacancy advertisements automatically post on other sites such as Zillow, Realtor.com, or Craigslist. Some can even help schedule showings for you.

- Potential tenants can easily apply from the listing ad and pay for screening reports directly.

- Some property management software products also can help with maintenance requests and schedule appointments with service professionals.

How to Collect Rent Online

Here are the common ways landlords are collecting rent online as well as some of the advantages and pitfalls to keep in mind.

ACH vs EFT vs eCheck

You may have seen these terms used before and are not sure what the differences are. In fact, we often use them interchangeably.

- EFT stands for Electronic Funds Transfer. This represents any type of payment that is made electronically. This can include ACH transfers, wire transfers, eChecks, and more.

- ACH is an Automated Clearing House transfer. This is a specific type of electronic payment between banks that uses the ACH network in the U.S. ACH payments include an added level of security, and can sometimes be reversed if there is a payment error.

- eCheck is short for Electronic Check and is a specific type of ACH payment. In a broad sense, eCheck is often used to mean any type of EFT payment, with the same set of benefits you get over paper checks: faster, cheaper, and safer.

In other words, ACH, EFT, and eCheck all refer to the same process of electronic transfers. All offer the same benefits and allow you to receive rent payments into your bank account without the hassles or dangers of handling cash or checks.

Peer-to-Peer Online Rent Payment Systems

There are various payment platforms these days that make sending and transferring money a breeze. They all essentially aim to make the transfer of funds as quickly and painlessly as possible. Though there are definite risks with using a peer-to-peer payment system, many landlords and tenants use these convenient options to collect rent online.

We have listed below many of the popular payment systems for rent collection, along with their pros and cons.

Zelle

Zelle is newer to the scene when it comes to banking. Unlike other online rent collection options, they work directly with various banks. When somebody sends money using the app, it sends you a notification and directly deposits the money to your bank account – if you already have an account within the app. If you don’t, no worries, you’ll receive a notification via email or text to help you set up your account. Once you do, you can access your money and transfer it to any other account you like.

One difference between Zelle and other options is that they don’t allow you to link credit cards. For some tenants who like the idea of racking up credit card reward points, this may be a deal breaker. Zelle also comes with a daily transfer limit, so tenants may have to schedule payments over a couple of days.

This leads to another issue with Zelle and some of the other peer-to-peer payment apps: If tenants pay their rent across multiple payments and days, landlords may not be able to block partial payments. In some locations, you may not be able to start the eviction process once you’ve accepted some of the rent money.

WARNING!

If a tenant sends a partial rent payment, landlords in some locations may not be able to start the eviction process.

PayPal

This ubiquitous payment service has been around since 1998, and over the years, it has changed the way businesses work. You can send invoices, request money on jobs with ease, and transfer the money into your account immediately. For landlords, we recommend setting up a business account separate from your personal account so you don’t commingle funds. You can keep track of your invoices conveniently, as well as take advantage of the platform’s payment protection plans. This is great for tax season because it allows you to have access to everything you’ve made at the touch of a few buttons.

The major disadvantage with PayPal is that every business transaction comes with a fee, which can add up quickly. Similarly, landlords cannot block partial payments, making potential eviction proceedings difficult.

Cash App

Released in 2013 by the payment processing company Square, this app didn’t start gaining popularity until recent years. Its set up allows you to directly connect a bank account for transfers. You can also enable direct deposits to make online rent collection even easier. Cash App users can also request a Visa debit card linked to an existing bank account.

The downsides to Cash App are that users are limited to how much they can cash out per week. This may be a particular issue for landlords with more than a couple of rentals. Additionally, tenants need to be extra careful when entering your payment information. If there is a mistake, their money can be transferred to the wrong account, with little recourse to get the funds back. Should a tenant claim they paid their rent but you never received it, this could be a major hassle to sort out.

Direct Bank Transfer

While these can be a little more difficult to set up, tenants can send rent payments directly to your rental property bank account. Because direct deposits require providing your tenants with personal details such as bank routing and account numbers, many people fear that these can be unsafe or insecure. Like with some of the other peer-to-peer options described above, there are no means to restrict a partial rent payment. A tenant might use this to send just a small amount each month without fear of eviction.

Property Management Software

Many landlords and tenants both see peer-to-peer payment apps and direct deposit options as cheap, simple, and easy to use methods for their online rent payments.

However, rental property management software may be the better option for online rent collection. Services like Avail, PayRent, and TenantCloud are safe and secure way to collect rent online, and provide you with a range of other property management features to help you run your rental business.

You can gain access to other valuable features such as advertising and listing, tenant screening, online applications, lease signing, maintenance management, financial reporting, and more. These software tools truly take many of the hassles out of being a landlord, and protect both you and your tenants.

The Best Online Rent Payment Services

We graded the top rent payment software tools across several key online rent collection features.

These are our winners:

-

PayRent –

Winner: Best Overall Online Rent Payment Service

Winner: Best Overall Online Rent Payment Service -

Baselane –

Winner: Best Integrated Landlord Banking and Rent Collection

Winner: Best Integrated Landlord Banking and Rent Collection -

TurboTenant –

Winner: All-in-one Rental Property Management Platform

Winner: All-in-one Rental Property Management Platform -

Avail –

Winner: Best Rent Payment Service within Complete Property Management Software

Winner: Best Rent Payment Service within Complete Property Management Software -

RentRedi –

Winner: Best Rent Collection App for Landlords and Tenants on the Move

Winner: Best Rent Collection App for Landlords and Tenants on the Move -

Azibo –

Winner: Free Rent Collection in a full property management platform

Winner: Free Rent Collection in a full property management platform

![]() Related: The Best Online Rent Payment Service for Small Landlords

Related: The Best Online Rent Payment Service for Small Landlords

Rent Payment Software – Our Top Picks

We considered the following top rental property management software products for the best online rent payment service. We specifically looked at features such as Payment Options; Automated and Recurring Rent Payment Scheduling; Speed; Cost; and Tracking and Reporting. We also gave a bonus point to software that reports late and on-time rent payments to the credit reporting agencies. Our detailed reviews of each product follows:

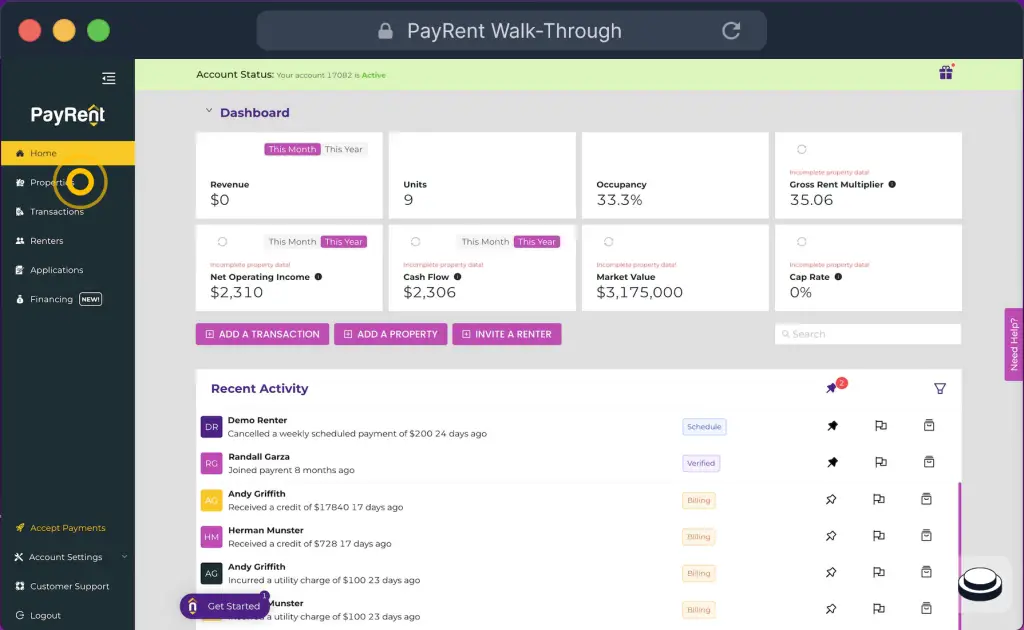

1. PayRent

Winner: Best Overall Online Rent Payment Service

- 3 different subscription plans starting at $0 per month allow you to choose the right set of features for your portfolio.

- Tenants can set up recurring payments so you know your rent will be paid no matter where they are or how busy they may be.

- Free credit reporting rewards renters for their largest monthly expense and encourages consistent on-time rent payments so you get paid.

- Strength: Rent Collection

PayRent is a product that focuses solely on online rent payment for landlords like us. With multiple plans starting at $0/month, landlords have access to a low-cost solution for collecting rent payments. Choose to pass-through transaction fees to your tenants, and your rent payment fees are $0 forever. Tenants will also receive rent reminders and can schedule automated payments in advance, helping to ensure on-time rent collection every month.

Additionally, PayRent offers a RentDefense feature with their paid packages: Payment controls and rent collection enforcement that help you collect rent with less hassle and stress that virtually eliminates late and lost rent. Landlords can also upgrade to a premium plan that promises just 1-day payment holds and free bank transfers.

Payment Options: Your tenants will have a choice of either e-check or credit card payment methods. Add your tenants to the platform and PayRent will send out an email invitation for them to join the service then help them through the process of adding a payment method.

Recurring Payments: Working late or going on vacation shouldn’t stop your tenants from making their online rent payment on time. Let them set up a one-time future payment, or weekly, semi-monthly or monthly recurring payments so you know your rent will be paid no matter where they are or how busy they may be.

Speed: PayRent can deposit your rent payments to any bank with branches in the United States, with a 3 day hold for users on the Pay-As-You-Go and DIY plans. This is expedited to a 1 day hold for their premium Go-Like-A-Pro subscribers.

Cost: PayRent offers 3 different plans as well. The free Pay-As-You-Go plan costs $5 per ACH transfer. The DIY plan costs $19 per month with $2 ACH transfers. And the Go-Like-A-Pro plan gives you free ACH transactions for a monthly subscription of $49.

Reporting: PayRent sends automated rent reminders to your renters which helps avoid last-minute confusion and stress. You will also receive instant email notification when rent is paid as well as full accounting and tracking of rent payments. There do not seem to be other reporting features that some of the other services offer.

Credit Agency Reporting: Landlords using PayRent to collect rent can use the credit reporting system to report rent payments to Equifax, Experian, and TransUnion. It reports both on-time payments and late payments for free. PayRent is the first company to report rent payments to all three credit bureaus.

If what you need is fast, secure, reliable online rent collection, PayRent is our winner for you. It is our Overall winner for the Best Online Rent Payment Service.

Get Started with PayRent for Free.

2. Baselane

Winner: Best for Integrating Rent Collection with Landlord Banking

- Integrated set of property management tools to help real estate investors and landlords save time and money while increasing their rental property returns.

- One platform for all your property banking & finances. 100% free.

- Tenants can pay by ACH bank transfer or debit/credit card, and can easily enroll in auto-pay.

- Payments are deposited directly into your bank account in as fast as 2 days.

- Strength: Landlord Banking

Baselane is a rental property management tool that helps landlords and real estate investors save time and money while increasing their rental property returns.

Along with having one of the best bank account options for landlords, Baselane offers debit cards with smart controls that allow cardholders to control and manage their expenses. You can also integrate it with your bookkeeping, reporting, analytics, and rent collection tools.

Payment Options: Baselane provides tenants a platform to pay rent on any device. Simply set up your lease, invite your tenants, and get paid. Tenants can pay by ACH bank transfer or debit/credit card and can easily enroll in auto-pay.

Recurring Payments: Tenants can turn on Autopay to schedule recurring online rent payments or get reminders when rent is due. No more late fees.

Speed: Payments are deposited directly into your bank account, sometimes as fast as 2 days. You will also receive automated alerts once rent is paid.

Cost: Free ACH payments for both landlords and tenants. There is a 2.99% fee for debit and credit card payments.

Reporting: Baselane offers automated payment notifications & reminders, automated payment history and tracking, and automated late fee settings. There is also integration with a Baselane banking account or external banks and credit cards to stay on top of finances in one place.

Baselane is currently offering a $150 bonus:

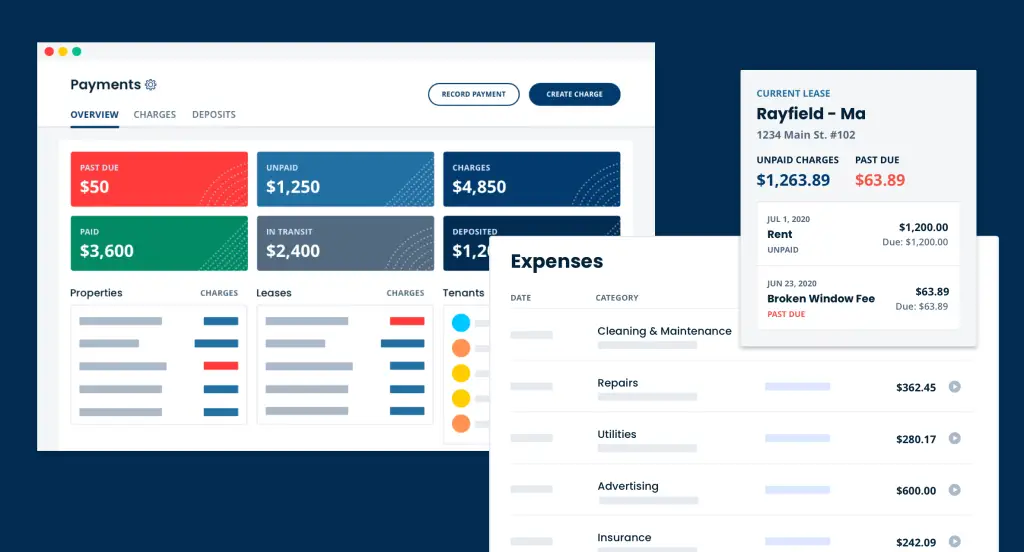

3. TurboTenant

Winner: All-in-one Rental Property Management Platform

- Landlord software that simplifies how you self-manage your rental business.

- Set up automatic late fees or turn on automatic payments for your tenants with email reminders and automated technology,

- Comprehensive payments dashboard and integrated accounting software provides a full view into your income and expenses

- Strength: Complete Solution

TurboTenant is online property management software that empowers independent landlords to:

- Advertise Vacant Units

- Track Leads Automatically

- Accept Online Applications

- Screen Tenants

- Create Lease Agreements

- Collect Rent

- Complete Rental Property Accounting

TurboTenant’s secure rent collection tool was created exclusively to meet landlords needs. Renters and landlords alike don’t have to worry about security when it comes to TurboTenant since they partner with industry leaders Stripe and Plaid to ensure everyone’s information stays safe.

Payment Options: Tenants can pay via ACH or credit/debit card.

Recurring Payments: Landlords can set up automatic late fees or turn on automatic payments for their tenants. With email reminders and automated technology, forgetful tenants are prompted to pay on time. And if they don’t, TurboTenant will let you know.

Speed: ACH Payments on average take 5-7 business days to be deposited into your bank. TurboTenanat offers expedited ACH processing with their premium subscription plan, decreasing the time to approximately 3 business days.

Cost: TurboTenant offers both a free and premium subscription. Under both plans, landlords have access to Autopay, Auto Late Fees, Rent Reporting, and Payments Dashboard features. ACH payments are free to both landlords and tenants. Tenants will incur a 3.49% convenience fee if they choose to pay with a credit or debit card. With a premium subscription starting at $99/year, landlords can get expedited rent payouts among other benefits.

Reporting: TurboTenant’s payments dashboard makes it easy to understand which tenants are completely paid up vs. those who owe money (and how much). It also shows how property expenses stack up against rent payments on an annual basis. Additionally, TurboTenant’s recent integration with REI Hub was tailor-made for landlords and their accounts. Rent collection data flows automatically into REI Hub’s system, meaning landlords can get straight to the reports they need faster than ever before, for just $15/month for the first property (and $5/month/property after that). Regardless of the number of units, users will not pay more than $85/month for this extraordinary tool.

Credit Agency Reporting: TurboTenant offers rent reporting to build tenants’ credit history when they pay rent online. Once Rent Reporting is activated, TurboTenant will automatically report your tenants’ on-time rent payments to TransUnion for free, helping them improve their credit scores.

Collect Rent Online – Sign Up for TurboTenant Free

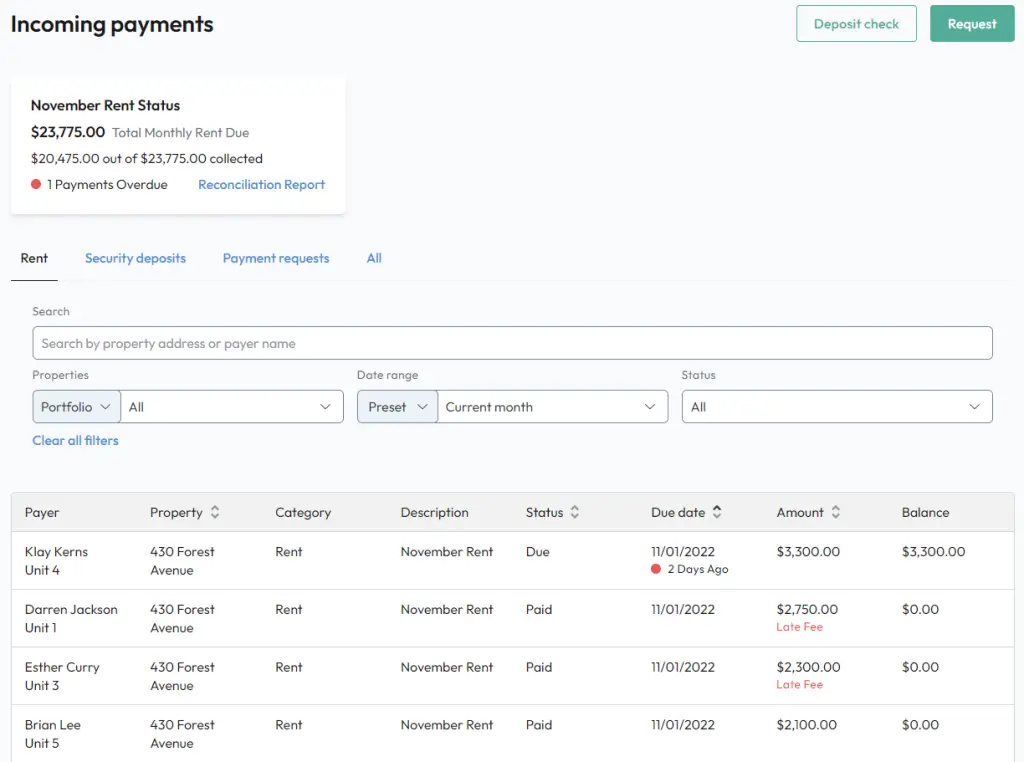

4. Avail

Winner: Best Rent Payment Service with Complete Property Management Features

- 2 subscription plans: $0 for Unlimited or $5/month per unit for Unlimited Plus

- Tenants can pay rent with a credit card or checking account, or use Autopay, which automatically withdraws the funds from their account each month.

- Rent payments deposit directly to your linked bank account in just three business days – less time than processing a paper check or visiting your local bank.

- With a subscription to Avail’s Unlimited Plus premium plan, next day “FastPay” payments are available to landlords at no additional cost.

- Strength: Complete Solution

Avail is our winner for the best online rent payment in the property management software category. With next day FastPay ACH transfers included for Unlimited Plus subscribers and 2-day deposit times for all others, Avail offers a fast and convenient rent payment service. Furthermore, landlords do not need to be a paid subscriber to access Avail’s online rent payment service. At $2.50 per transfer that your tenant can pay, a landlord has the opportunity to collect rent at no additional cost.

Payment Options: Tenants can pay however they want, from bank accounts or credit cards. They can also pay from any device that has access to the internet. Getting started is simple. Enter the rent amount and lease dates, your tenant’s name and email, and Avail will handle the rest.

Recurring Payments: Tenants can turn on Autopay to schedule recurring online rent payments. They simply choose a date to withdraw the funds, and Avail will deposit the funds directly to your account. Landlords can also manually add custom payment dates if they want to create an installment schedule for their tenants.

Speed: Payments typically deposit directly to your bank in 3 business days, faster than a check and without the hassle of a trip to the bank. With a subscription to Avail’s Unlimited Plus premium plan, next day “FastPay” payments are available to landlords at no additional cost.

Cost: Using Avail’s free Unlimited plan, ACH transfers cost $2.50 per transaction. With the premium Unlimited Plus plan, landlords receive free ACH transfers. And under either plan, credit or debit card transactions are charged a 3.5% transaction fee.

Reporting: Avail offers automatic reminder emails and built-in payment receipts. Late fees can be automatically assessed as well. Landlords have access to payment tracking and reporting, though integration with your accounting or bookkeeping software may be limited.

Credit Agency Reporting: Avail can report your tenants’ on-time rent payments to Transunion with their CreditBoost service. Your tenants may see up to a 40 point increase in their credit score.

What makes Avail a winner is their best-in-class property management software solution. In addition to online rent collection features, a subscription to Avail gives you a complete set of tools, guidance, and educational content you need to be a confident and professional landlord.

5. RentRedi

Winner: Best Rent Collection App for Landlords and Tenants on the Move

- One dashboard to manage your rentals, receive payments, screen applicants, manage maintenance requests, and list properties

- Add payment accounts to each property to start collecting & tracking rent

- Receive funds from tenants in as quick as 4-5 business days

- Strength: Complete Solution

RentRedi is a landlord-tenant app that allows you to manage vacancies, screen tenants, and collect payment from wherever you are, on any device. RentRedi’s mobile deposit feature makes it easy for tenants to pay their monthly rent on time. There is an option for automatic payments that will also send rent reminders. If a tenant falls behind on rent, they will incur an automatic late fee with a recurring fee amount.

RentRedi also offers a free rent collection app that both landlords and tenants can use to pay and collect rent online. This is the best rental payment app and makes it a great option for busy landlords can use on the move!

Payment Options: RentRedi allows payment from a banking account, credit card, or ACH. They also allow tenants the option of depositing cash at over 90,000 retail locations through RentRedi’s partnership with Chime.

Recurring Payments: Tenants can choose to enable auto-pay and schedule recurring rent payments for the same date each month.

Speed: Landlords will receive payment from tenants in as quick as four to five business days after payment account approval.

Cost: There is a $1.00 processing fee for ACH payments, which tenants will pay. There is also an option to make payments through a credit card, though a 2.9 percent plus $0.30 fee will incur. If you prefer, you can cover the fees instead of passing them onto your tenant.

Reporting: RentRedi allows you to set up automatic late fees and directly export rent payments to spreadsheets or Quickbooks Online. You can also send in-app notifications by unit, property, or to all tenants.

Credit Agency Reporting: With RentRedi, you can reward and encourage on-time rent payments with their credit boost feature which reports rent to credit bureaus.

6. Azibo

Winner: Free Rent Collection in a full property management platform

- Azibo’s core features are free to use, with optional additional services that can be purchased.

- Securely accept multiple payment methods online including credit card, debit card, and ACH bank transfer.

- Payments process within 3 business days.

- Rent dashboard helps you view tenant payments in one place and get alerted about uncollected payments.

- Strength: Complete Solution

Azibo is an easy-to-use rental property management tool that allows you to receive online rental applications, screen tenants, collect rent (credit card, ACH, or debit card payments), and manage accounting with rental-focused tax prep tools and reporting. Along with all these features, it also offers a landlord-centric bank account with zero monthly fees.

Online rent collection is one of Azibo’s core features that is free to use. You can get paid automatically on Azibo via credit card, debit card, and ACH. Azibo also allows you to:

- Receive your rent payments within 3 business days.

- Instantly see the rent payment status of your residents.

- Send reminders via email and SMS to whoever needs to pay rent soon.

- Allow your residents to make partial rent payments – nor not.

- Automate late fee enforcement that are customizable based on your lease terms.

- Easy security deposit tracking – both collecting and returning at the end of the lease.

- Get alerted automatically about uncollected payments.

Payment Options: Securely accept multiple payment methods online including credit card, debit card, and ACH bank transfer. Simply add your properties and open an Azibo bank account or link your existing bank account. Then invite your tenants to join Azibo and start collecting online rent payments.

What stands out with Azibo is the ability to turn on or off partial payments. While we recommend not accepting partial payments since it makes potential eviction proceedings more difficult, you can choose to enable them for a special circumstance and then disable them again going forward.

Recurring Payments: Tenants can set up AutoPay to make sure that they never miss a rent payment. They would simply switch the toggle on and adjust the auto-pay settings. They can edit these autopay settings at any point.

Speed: Azibo processes payments within 3 business days, similar to best rent collection platforms.

Cost: ACH payments are free, or your tenant can use a debit or credit card (2.99% convenience fee).

Reporting: Azibo has a rent dashboard that helps you view tenant payments in one place so you can instantly see who paid and who hasn’t. If you choose, late fees will be included with the rent invoice amount and can be waived manually at any point. You can also reconcile your payments by downloading a spreadsheet with a breakdown of all payments made to you on Azibo within a selected time period.

![]() Related: Collect rent online: 8 tips to choosing the best service

Related: Collect rent online: 8 tips to choosing the best service

Conclusion

All of the options we’ve listed offer a slightly different experience when it comes to receiving rent payments. Each of them helps take the stress out of collecting rent payments every month. In conclusion, take a spin with one or more of the best online rent payment systems outlined above, to see which service best fits your needs.

About Landlord Gurus

At Landlord Gurus, our commitment is to provide expert advice on the complex and important issues faced by landlords and property managers. Together we have over 30 years of experience in residential property ownership and management. In addition to sharing our own expertise and experiences, we call on specialists in fields including maintenance, law, tenant management, and more. Where we see topics that require more in-depth discussion, we create insightful articles that provide valuable information and guidance.

Disclosure: Some of the links in this post are affiliate links and Landlord Gurus may earn a commission. Our mission remains to provide valuable resources and information that helps landlords manage their rental properties efficiently and profitably. We link to these companies and their products because of their quality, not because of the commission.