Managing books and record keeping for rental properties can be confusing, cumbersome, and stressful. However, there are several ways to make the process easier. If you’re looking to maximize returns on your real estate investment, it’s important to understand the basics of accounting for rental property. In this article, we share some tips and tricks as well as tools to make rental property accounting easier for landlords.

Why is Rental Property Accounting Important?

Accounting for rental property is crucial for landlords as they need to be able to keep track of the money flowing into and out of their rental business. Understanding how each transaction can affect your investment is extremely beneficial in making plans and decisions. You also need to analyze the health of your real estate investments to gauge their profitability in a fluctuating housing market.

Rental property accounting helps landlords develop processes to grow and scale their investment portfolio, and make sure expenses are paid on time. Landlords can prepare reports and statements to track the performance of properties, which simplifies tax filings.

Incorrect bookkeeping and accounting practices can result in lost rental income, overpayment of taxes, higher expenses, and low returns on investment. With a proper rental accounting system, landlords can yield better returns from rental properties and earn tax benefits offered by IRS.

Rental Property Accounting Basics

Here are some of the best practices for rental property accounting that landlords should follow:

1. Have Separate Bank Accounts

Having separate bank accounts keeps a landlord’s personal funds separate from business funds. This allows you to better track income and expenses and simplify accounting and bookkeeping. Moreover, by avoiding the commingling of funds, you can protect your assets and also make things easier for yourself at tax time.

A dedicated bank account for rental property creates a more professional and credible image in front of tenants and real estate investors. You can also enjoy rewards and extra features with some landlord banking accounts.

Furthermore, having a separate bank account for each rental property becomes more important once you start scaling your portfolio. Over time, you’ll have more transactions to manage, which means you’ll need to maintain accurate books.

![]() Also Read: Landlord Banking: Landlord Gurus Experience

Also Read: Landlord Banking: Landlord Gurus Experience

2. Track Income and Expenses

If you own a rental property, you have to report all of the rental income you receive. However, keep in mind that it includes more than just those monthly rent checks. For example, any expenses your tenants pay to you such as utilities, laundry revenue, late fees, and other fees, also count as rental income.

Security deposits aren’t taxable if the intent is to return the money to the renter at the end of the lease. But if your tenant moves out during the lease term and you use the money for repairs, you have to include that amount as income for that year (you can also deduct the repair expenses). Keep in mind that a security deposit used as a final rent payment is considered advance rent. Therefore, you should include it as income the year you receive it.

Along with income, landlords should track expenses related to buying, operating, and maintaining the property. This will help you receive tax deductions at the time of tax filing. For example, you can deduct mortgage interest, repairs and improvements, property taxes, business-related travel expenses, and other operating costs as business expenses. This record keeping also helps when you want to calculate performance metrics for your property. Finding your Net Operating Income (NOI) is one example.

3. Use Landlord Accounting Software and Reporting Tools

Landlord accounting software and reporting tools allow you to automate and capture the financial status of your rental property with minimal effort. You can save time, keep all your transactions organized, and get useful insights into how your rental business is performing. You can see the big picture with comprehensive dashboards.

A landlord accounting tool also helps you automate payments and reminders. Some even provide the ability to collect rent online and digitize and save receipts, which come in handy during tax season.

![]() Also Read: Rental Property Spreadsheets: Should Landlords Use Excel or Property Management Software?

Also Read: Rental Property Spreadsheets: Should Landlords Use Excel or Property Management Software?

4. Use Rental Property Calculators

Landlords should also know how to calculate metrics that will help them make the best decisions. They are great tools to help measure how well your properties are making you money. Some of the metrics you should track are:

- Net Operating Income (NOI)

- Capitalization Rate (Cap Rate)

- Gross Rent Multiplier (GRM)

- Cash-On-Cash (CoC) Return

- Debt Service Coverage Ratio (DSCR)

- Operating Expense Ratio (OER)

- Return on Investment (ROI)

- Internal Rate of Return (IRR)

These rental property calculators can help you get a better understanding of your real estate business whether you’re new to property investing or a seasoned professional.

5. Prepare for Tax Season

Preparing yourself for tax season will help you simplify your tax return filing and maximize the benefits available to rental property investors. It’s important to maintain good records in order to track the financial performance of your rental investment. With accurate financial statements, you’ll always be prepared in case of an audit.

You also need to understand the difference between improvements and repairs. The expense of property improvements has to be capitalized and depreciated over several years instead of deducted in the year paid. On the other hand, repairs are treated as maintenance expenses and deducted from the year’s income.

If needed, hire an accountant to manage your books and file your tax return. They will help keep you organized, give strategic advice, and provide peace of mind knowing that your property’s finances are in good hands.

![]() Also Read: Rental Property Taxes: 8 Tax Tips for Landlords

Also Read: Rental Property Taxes: 8 Tax Tips for Landlords

Landlord Accounting Software

Many rental property accounting software offer features that help landlords and rental property investors simplify their bookkeeping. Here are a few of our favorite tools:

Stessa

Stessa is an easy-to-use reporting and accounting tool that allows you to link your property information and accounts and gain access to a current view of how your portfolio is performing in real time. Within minutes, you can get the insights you need at your fingertips to make better decisions.

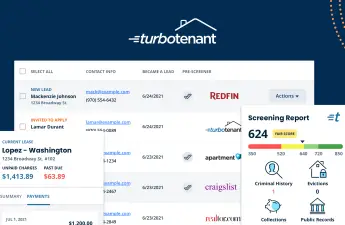

TurboTenant

TurboTenant is a full-featured property management platform that offers an optional rental property-specific accounting and bookkeeping add-on through their partnership with REI Hub. With TurboTenant you can get leads, screen tenants, create leases, and collect rent: all in one place.

Rentec Direct

Rentec Direct is another full-featured property management software that provides robust tax reporting features. You can easily find the right information you need at tax time. It allows you to collect rent online via ACH, credit card, or electronic cash payments, which are automatically tracked and recorded in your software.

Landlord Studio

With Landlord Studio, you can track and create income vs. expense reports to easily manage your finances. You can organize your reports by property for unit-level expense tracking. This can help you identify which units are costing you the most and which ones are the most profitable. You can also create professional schedule E reports for your taxes.

Do You Need an Accountant for Rental Property?

Not necessarily. With the availability of tools discussed above, many landlords and rental property investors do their own bookkeeping and income/expense tracking. In fact, many landlords only utilize a professional tax advisor to file year-end returns. However, hiring CPA or accountant to file your annual tax returns can be worthwhile. They can make sure you’re not missing important deductions that can reduce your tax bill. Moreover, they provide additional assurance that you have done everything correctly.

![]() Also Read: Money Management 101: Best Finance Practices for Landlords

Also Read: Money Management 101: Best Finance Practices for Landlords

Rental Property Accounting: Landlord Gurus Takeaway

With plenty of landlord accounting software tools out there, you don’t need to be an accountant. However, it is important to understand processes and what you need to track and utilize available tools to create and follow a good accounting system.

There’s a lot involved in getting your rental property accounting up and running. We hope this guide helps you take the next step in the right direction.

Disclosure: Some of the links in this post are affiliate links and Landlord Gurus may earn a commission. Our mission remains to provide valuable resources and information that helps landlords manage their rental properties efficiently and profitably. We link to these companies and their products because of their quality, not because of the commission.