In this video, founders Chris Lee and Eli Secor do a Baselane landlord software review. What features does Baselane provide? How much does it cost? What are the highlights of Baselane that Chris and Eli have noted?

Topics in this video include:

- What is Baselane? [0:58]

- Baselane banking [1:13]

- Rent collection [4:25]

- Other features [6:52]

- Baselane highlights [9:12]

- How much does Baselane cost? [10:29]

- Takeaways [11:39]

Transcript

Eli Secor: Hello, you’ve got Chris and Eli from Landlord Gurus here again. And today, we’re going to talk about one of the products that we feature and many of our readers use and enjoy. So the product is called Baselane. You have many, many choices out there in the realm of property management software.

This is a product that focuses on banking for landlords. There are some really great features that we’ll get into in that particular functionality. We’ll give you an overview of what Baselane’s features are, give you pricing highlights, some things that we really like, a few thoughts we have on what could be improved, and touch on just some other considerations you might take into mind when you’re choosing a software product.

So, Chris is going to start us off with an overview of some of those features.

Chris Lee: Yeah, thanks Eli. So yeah, I mean, what is Baselane? Baselane, what they like to say is they’re a free landlord software that aims to simplify rental property finances. They do this primarily through rent collection, bookkeeping and accounting, and through banking. I’ll start with their banking products.

What stands out initially is currently they’re offering a 4.19% annual percentage yield, so it’s a good interest rate compared to a lot of other banks. They say that it’s like 60 times the national average. They also offer a cashback feature up to 5% for certain transactions, certain expenditures, particularly for property or home improvement purchases.

Their banking, they say, is made specifically for real estate and for landlords. You can open an account quicker. It’s all online. You can do that quicker than actually having to go to a physical bank.

ES: Within a day.

CL: Yeah, I mean, they say sometimes as quick as four minutes. I mean at worst if it requires a manual approval, yeah, at most a day.

ES: Hey, Chris, backing up just a minute. That cashback offer, is that based on use of their debit cards?

CL: Yeah, it’s using their debit card.

ES: We’ll get into that more.

CL: Right. With Baselane banking you can open up, not only your main account, but you can also open up multiple virtual accounts within that one bank account. Each of these is basically treated as a separate account, they got their own account numbers. In that way, you can kind of keep money and keep transactions separate. It’s useful for organizing those transactions, organizing your finances, you can deposit or withdraw from any of the specific accounts.

And you can even track transactions or assign transactions to separate properties or even down to the unit level. One thing that struck me is that you can keep one separate for security deposits. In some places you’re required to keep your deposits in a separate account and not commingle. That way when someone moves out, everybody knows that that money hasn’t been touched and it’s in a separate account.

So you can do that with one of these virtual accounts, and kind of keep your hands off of that until you need to use it.

ES: Maintenance reserves too, right? You can set up utilities accounts and maintenance reserves.

CL: Exactly.

ES: It’s up to how you want to track and separate.

CL: Yup, exactly. And you can have multiple of those virtual accounts. As far as I know it’s unlimited, maybe? I don’t know.

You can also get virtual debit cards. I think you can get a physical debit card, but for all these virtual accounts, you can get virtual debit cards.

And that way, if you say, have, people working for you or with you, or assistance, you can assign them a virtual account number and they can go use that and make purchases and you can then track better those expenses and see who is doing what. It’s just an easier way to, to keep that separate and to keep those secure. You don’t have to keep track of a card and give it to different people at different times.

ES: And they’re spending from the appropriate accounts then.

CL: Exactly. Yep.

One last thing to talk about here with banking is that these accounts are FDIC insured. You’re protected so that you’re not responsible for unauthorized charges if your going to get stolen or whatever, and it is encrypted.

And so, you can trust that there’s a physical bank behind it all. And it is protected.

ES: Okay. I’ll pick up a few more. Some of these features are more general, property management software type features, most important being online rent collection. So, this functions like many property management software products do, where you can collect rent from your tenants that can be directed to whichever of these accounts that Chris has just described that you want. You can assess late fees.

Automatic late fees they have, it’s a quick payout time. It’s what’s called an ACH transaction, which is bank to bank, basically. So, that usually takes a couple of days, there is a small fee that is paid by the tenant. That’s $2 per transaction.

You can do credit or debit cards, as usual. It’s usually about 3%. I don’t know the specifics here. There are some integrated banking features, that the landlords can choose. How they want to use, which deposits you want to send where, and that type of thing, including the security deposits.

The accounting features like Chris has touched on, are really robust. So you can get really granular with how you track your income, laundry, individual units, individual properties. Things can get really broadly detailed and spread out, or you can keep it simple.

I think probably the most compelling feature for me, aside from a great interest rate, is that you don’t need an outside bookkeeping or accounting software like QuickBooks. So this is set up so that you have all the pre populated categories and expenses. You can create your own as well, but utilities, taxes, you don’t have to to create the master account and all the categories.

CL: Right. Yeah, and they set this up and they created this specifically for landlords and for real estate transactions. So, it’s all been thought out. It doesn’t have other categories that you might not need that QuickBooks might have, so it’s specific to the type of things that we do.

ES: Quick and not a lot of set up.

CL: You can export those reports as well and send them to your bookkeeper, your account.

ES: Absolutely. I think that’s one of the key things that I would do using Baselane. Also to point out that you can import transactions from outside credit cards and bank accounts.

You don’t have to start completely from scratch or make an entire transition right off the bat.

All right, Chris, you got some additional features for us.

CL: Yeah. So in addition to what we just talked about, they also have some other features that you can utilize that are free.

You can get free rental price estimates. We’ve talked about some of the other products before, but it functions the same. You can put the properties address and you get comparables for other properties in the area and you end up with a rent pricing range that you can use as your starting point for listing your property.

ES: And it’s fairly costly with a lot of the other. So, this being free is really nice.

CL: Yeah, exactly. They also have free, online rental property calculators. So, you can plug in purchase price or potential price and potential rent. If you’re an investor, you can see, whether a particular property might be something that you want to move forward with or not.

ES: That’s an analyzing a deal. You know, not once you already own the property. It’s actually a pretty slick feature that they’ve got. It’s graphical and really easy to put in the variables and kind of play around with it.

They’re also working on some upcoming features that they’re gonna roll out, mostly that later this year, I believe. So they’re gonna take another step with the late fees and make it so that you can customize how those work. Whether it’s a one time fee, whether it’s a percentage, or whether or not it’s stepped, based on how late it is. They’re working on that.

They’re also working on a feature where you can make rent payments biweekly. This is great for, a gig worker who gets paid every other week or just has cash come in and wants to make the payment right there and make sure it gets done. They are partnering with Rocket Lawyer to offer 50 state leases, which we’ve done lots of writing and talking about.

![]() Also Read: State Specific Residential Lease Agreements

Also Read: State Specific Residential Lease Agreements

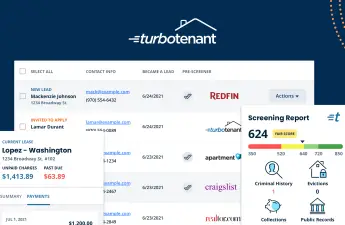

It’s invaluable to have a resource where the leases are custom to your state. They don’t do tenant screening yet, but they’re working on that so that you can get background, eviction, and credit reports, right there. This is fleshing out some of those property management features that other products do, and they don’t yet, but they’re building them.

CL: Yeah. And, we’ve got an article on our website. We’ll post the link here in the video where you can go check out what we’ve written about an overview of their features and see what they’ve got.

![]() Also Read: Baselane Overview: Landlord Banking & Rental Property Finances

Also Read: Baselane Overview: Landlord Banking & Rental Property Finances

This is also a good time where we can remind you to like and subscribe to this channel, if you want to receive more content like this.

So for me, the highlights that Baselane has to offer, the number one is that it’s free. And that’s a pretty big, compelling feature. We also like the integrated banking, again with those interest rates that are higher than most other banks out there. As Eli discussed, there are those robust accounting features that you can integrate with your bank and with rent collection, and then the virtual accounts that I talked about where you can separate finances where appropriate.

ES: Yeah, and we also considered some areas where we thought Baselane could improve or where there were some offerings that they didn’t have.

Generally, it was some of those property management software functions that we’ve touched on. However, like I mentioned, they’re building a lot of that out. So screening, I think is a great thing to have integrated, especially if you’re going to move that tenant into rent collection, have it all, streamlined there.

The only other thing that I think is a minor quibble, is that you can get very granular and fairly complicated with setting up all kinds of accounts and creating your own categories and tracking. And I just think, for most of us, keeping it simple, which you can absolutely do here, is going to be important.

Start simple at least. So, don’t get over complicated.

CL: Right. It’s a good lesson for everybody in everything. So, pricing, how much does the Baselane cost? We talked about this, it’s free. There’s no account opening fees, no rent collection fees, no account minimum fees, no monthly fees, no inactive account fees. No ACH transfer fees, at least for the landlord, there might be some for the tenants. There’s no return item fees, no overdraft fees, and no bookkeeping fees.

ES: That’s pretty good. I didn’t realize that there were no return item or overdraft fees. That’s actually uncommon.

Now, there are some alternatives to Baselane. There are products out there that do the full host of property management software functions. There are some that even have comparable accounting and bookkeeping features. And there are some that also have strengths in managing maintenance, with included dispatch of vendors of their choosing.

There are some products that have an add-on feature for accounting, but that do a fairly comparable job to this. So, yeah, we’ve written about lots and lots of, software products out there. So go to landlordgurus.com, browse around, and you’ll see lots of options.

CL: So takeaways. For me, the Baselane bank account looks really enticing. Again, those interest rates look great, and the ability to set up those virtual accounts to separate your finances based on your property or even down to the unit level, really could be really helpful. And then, yeah, again, it’s free.

ES: Everybody likes free.

So my takeaway, as Chris said, the rates. I think that’s really compelling. And then the fact that you can use this product, not need another accounting or bookkeeping software. It’s set up for you already, to operate your rental business and keep very good records.

Those accounts that you can set up to keep everything separate, I think are great, and Quickbooks or software like that can be expensive. So I think there’s really a savings financial here as well.

CL: Great. Yeah. That’s basically it for Baselane. Again, like with some of these other videos, just a quick disclosure that we are partners with Baselane.

So if you go from our site to go sign up with Baselane and start collecting rent or open up a bank account and deposit a certain amount of money, we will receive a small commission. So, just full disclosure, but if you’d like what we have to say about it and you do that, we do appreciate it if you went through our sites. Again, like and subscribe.

We’ve got other videos that we’ve recently done on some other products, so you can check those out as well on our YouTube channel. So thanks for watching. Until next time.

ES: Thanks for watching. Bye.

Disclosure: Some of the links in this post are affiliate links and Landlord Gurus may earn a commission. Our mission remains to provide valuable resources and information that helps landlords manage their rental properties efficiently and profitably. We link to these companies and their products because of their quality, not because of the commission.