Update May 23, 2025: TurboTenant has recently announced its’ acquisition of competing property management software company Azibo. According to TurboTenant’s press release dated May 6th, 2025, “Azibo’s technology will continue to support current users during the transition, with the TurboTenant team ensuring a smooth onboarding experience. This will ensure current users experience continuity, while gaining access to new capabilities as the platforms combine.”

There are lots of property management products out there that can help independent landlords. Here we’ll review one of the products that many of our readers and followers have had good luck with, Azibo.

We’ll give you an overview of the features, highlight some of them that really stand out to us, and offer our thoughts on areas for improvement. We’ll also provide a few alternatives that you might consider depending on your needs, and finally leave you with our overall takeaways on Azibo’s landlord software.

Azibo Landlord Software Features:

Applications: Azibo offers free online rental applications. The applications are pre-filled with standard prompts and questions, such as name, email, phone number, date of birth, desired move-in date, and rental, income, and employment history. This is all done online and can be sent to tenants via a link.

Tenant Screening: Once the application is done, they can move onto tenant screening. Avail includes a full credit report, identity validation, nationwide criminal history report, and eviction record reports. The applicants cover the cost — $39.99, which is pretty standard.

Lease Agreements: Azibo partners with RocketLawyer, allowing you to create custom, state-specific lease agreements. We like the user-friendly interface, as the platform populates core lease terms from tenant applications. This does have a fee of $29.99 for the landlord. However, if you are part of a rental housing association that has a partnership with Azibo, your leases and documents from your association are populated in Azibo and you can use those and integrate them with e-signing. This is a unique feature that we haven’t seen anyone else do.

Renters insurance: Landlords can also require renters insurance, which the tenant can purchase through Azibo, or upload their proof of insurance.

Online rent collection: Azibo also offers online rent collection where tenants can pay by credit, debit, or ACH. Some key standouts that we noticed is that you can monitor the rent payment status of all tenants through your dashboard. You can also allow or block partial rent payments. Azibo allows you to set up and enforce late fees automatically, which are customizable based on lease terms. Lastly, we like that you can track security deposits, from collection to return at the end of the lease term.

Banking: Another thing that stands out to us is that Azibo has their own banking platform. You can open accounts directly and link multiple outside bank accounts. They also allow you to link credit cards to auto-track your payments to vendors. Azibo also lets you pay bills through their platform. This is great if you need to pay for things such as utilities or mortgages, as everything will automatically be tracked.

![]() Also Read: How Does a Landlord Bank Account Make Financial Management Easier?

Also Read: How Does a Landlord Bank Account Make Financial Management Easier?

Bookkeeping: Azibo offers a sophisticated rental property accounting and bookkeeping system that has been developed specifically for landlords and property managers. You can split transactions across properties/units and create rules to automatically categorize transactions. Azibo claims that some landlords can save up to 80-90% of time spent on bookkeeping tasks. We think this is great because you won’t need to pay for a separate platform, like Quickbooks, that doesn’t have preset categories for real estate.

Maintenance management and tracking: Tenants can send and initiate maintenance tasks. Through Azibo’s in-app messaging, they can send photos and messages to you, while also submitting requests. We also like that you can schedule appointments.

Landlord insurance: Azibo is the only national insurance provider dedicated to rental property owners. You can get a quote directly from their website.

Full-scale accounting functionality, and complementary suite of useful features make it a fantastic option for landlords and property managers looking to streamline their workloads, save time, and grow their business.

STRENGTH: Complete Solution

Highlights:

Here are some of the features that we think make Azibo stand out:

- We like that Azibo offers truly free ACH rent payments — this was one of the key must-haves from the CEO.

- Another highlight is the integration of rental association leases and forms. If you are already a member of an association that has a partnership with Azibo, you have those in one place along with e-signing capabilities.

- We have also found that the landlord dashboard is easy to use and navigate. Everything you want to see is right there. It provides your rent status (most important data for most landlords) front and center, so you can quickly see what’s overdue, processing, paid, etc. You can also see which leases are about to expire.

- Azibo’s bill pay through their banking feature stands out as well. You have the capability of having an Azibo bank account and paying bills through their platform. Everything is automatically tracked through their bookkeeping. You still have the option to link outside bank accounts and credit cards, and then import that information. We like that there is a lot of flexibility with this function.

Areas for Improvement:

Azibo provides many great features, most of them for free, but there are a few things we’d like to see as they continue to improve their product. They have indicated that they are continuing to improve and upgrade their product with new features.

- One thing that Azibo does not offer is advertising and listing. We presume that it’s because Zillow is the primary player, making it difficult to break into this area. We have mentioned before that Zillow is making it difficult for others to post listings on their platform, and you likely need to do so separately.

- Azibo also does not offer a reference-checking feature. We would like the handiness of the platform sending automatic emails to tenants’ references.

- We would also like a maintenance scheduling feature to coordinate tenant and handyperson access.

Pricing:

Azibo stands out as a product that you can use entirely free. However, there are some additional services that can be purchased.

| Online rental application | Free |

| Online rent collection | Free ACH transactions |

| Landlord bank account | Free (no monthly fees) |

| Accounting, reporting, & tax prep tools (Including Schedule E, rent roll, income and cash flow statements) | Free |

| Maintenance coordination and tenant messaging platform | Free |

| Custom state-specific lease agreements and e-signature | $29.99 |

| Tenant Screenings | $39.99 (paid by applicant) |

| Rent paid by debit or credit card | 2.99% transaction fee |

| Renters insurance | Paid by tenant |

| Landlord insurance | Request quote through site |

| Optional rent payment reporting to credit bureaus | $4.99/month (paid by tenant) |

| Optional premium onboarding (for those with larger portfolios) | One-time $300 fee |

Alternatives to Azibo:

We have also identified some alternatives to Azibo. These are platforms that have a different twist, which might meet your needs in different ways.

RentRedi is a great full-feature property management software. They offer a maintenance add-on and they will handle your maintenance requests for you. No more late night emergencies!

Avail is another full-featured property management software product. One thing that stands out is that they offer automatic reference checking.

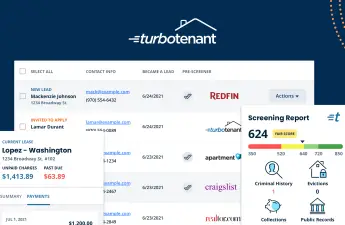

TurboTenant also has similar features. They offer an accounting add-on service through REI Hub, a very robust accounting tool.

![]() Also Read: Avail Landlord Software Review: What We Think

Also Read: Avail Landlord Software Review: What We Think

![]() Also Read: TurboTenant Review: What We Think

Also Read: TurboTenant Review: What We Think

Our Takeaways:

Azibo Landlord Software Review: FAQs

While Azibo does not offer any subscription tiers, and many features are free, there are certain features that may require payment.

Azibo makes money through interest on cash balances held in Azibo bank accounts, as well as through the 2.99% convenience fee when tenants pay rent with a debit or credit card.

Azibo also serves as a banking platform, which is an FDIC-insured institution.

Azibo serves as a property management software that allows you to manage your properties. Starting from the application process, they offer many solutions to make things easier and stay organized.

Disclosure: Some of the links in this post are affiliate links and Landlord Gurus may earn a commission. Our mission remains to provide valuable resources and information that helps landlords manage their rental properties efficiently and profitably. We link to these companies and their products because of their quality, not because of the commission.