Maximizing your rental property’s profit is key in the world of real estate investment. At the core of this goal is Net Operating Income (NOI), a vital metric indicating a property’s financial health. Boosting NOI isn’t just about making more money; it’s a smart move to strengthen your investment.

A higher NOI not only means increased revenue but also boosts your property’s value, attracting better financing and more investors. This article explores why NOI matters and shares easy techniques, like using a net operating income calculator and adjusting rent strategically, to take your rental property’s financial success to new heights.

Understanding Net Operating Income (NOI)

Net Operating Income (NOI) is a critical metric in the domain of real estate investment, offering property owners valuable insights into their asset’s financial viability. Simply put, NOI is the income generated by a property after deducting all operating expenses, excluding financing costs and income taxes. This straightforward calculation provides a clear snapshot of a property’s ability to generate positive cash flow from its day-to-day operations.

Understanding NOI is vital for property owners due to its role as a key measure of a property’s operating profitability. It goes beyond mere revenue figures, offering a comprehensive view of the property’s financial health by factoring in essential operating costs.

A positive NOI signifies that a property is generating enough income to cover its operational expenses, indicating a healthy and sustainable investment. As property owners navigate the complex landscape of real estate, grasping the significance of NOI empowers them to make informed decisions, optimize profitability, and ensure the long-term success of their investments.

Utilizing the Net Operating Income Calculator

A net operating income calculator is an invaluable tool that empowers property owners to gauge their property’s financial health with precision and make informed decisions for enhanced profitability. Here’s a step-by-step guide on how to effectively utilize an NOI calculator:

Gather Income Data

Start by compiling all sources of income generated by your property. This includes rental payments, fees, and any additional revenue streams.

Identify Operating Expenses

List out all operating expenses associated with the property, such as property management fees, maintenance costs, utilities, and property taxes.

Enter Data into the Calculator

Utilize the NOI calculator by inputting the gathered data. Most calculators have user-friendly interfaces, allowing you to enter income and expense details seamlessly.

Review the Results

Once the calculator processes the information, review the calculated Net Operating Income. A positive figure indicates that your property is generating more income than it incurs in operating expenses.

Analyze Trends and Variances

Use the calculated NOI as a benchmark to analyze trends over time. Identify any significant variances, allowing you to pinpoint areas for improvement or optimization.

Make Informed Decisions

Equipped with a clear understanding of your property’s financial health, you can make informed decisions to enhance profitability. This might involve adjusting rental rates, optimizing expenses, or exploring additional income streams.

Increasing Rental Income

To boost rental income and increase NOI, landlords can adjust rents strategically based on market trends. Clear communication with tenants about these adjustments is crucial for understanding. Offering extra services like maintenance or security features can justify higher rents by enhancing property value.

Adapting to market demand and making property improvements, such as energy-efficient upgrades or modern appliances, positions the property well for increased rental rates. Implementing incentives, like rent discounts, for lease renewals encourages tenant retention, ensuring a steady income.

By employing these straightforward strategies on how to increase rent, landlords can effectively enhance rental income, strengthen NOI, and secure long-term financial success for their properties.

Enhancing Property Value

Elevating property value significantly contributes to NOI growth. Renovations, upgrades, and enhanced curb appeal attract higher-paying tenants, allowing landlords to command premium rents. Beyond immediate rental potential, these improvements foster tenant satisfaction, reduce vacancies, and position the property competitively in the market.

Additionally, operational efficiency increases through energy-efficient upgrades, minimizing costs and maximizing NOI. Long-term appreciation and equity opportunities further solidify the positive impact of enhancing property value on sustained NOI growth.

Reducing Operating Expenses

Landlords can enhance NOI by implementing cost-cutting measures. Efficient property management, streamlined vendor contract negotiation, and energy-saving initiatives are key strategies.

Adopting proactive property management practices, negotiating favorable vendor agreements, and embracing energy-efficient solutions reduce operating expenses, directly contributing to NOI improvement. These practical tips empower landlords to maximize profitability by minimizing costs and ensuring efficient property operations.

Adding Income Streams

Property owners can boost NOI by diversifying income streams beyond traditional rent. Adding amenities, providing storage space, or forming partnerships with local businesses are effective strategies.

These initiatives not only increase property value but also generate additional revenue, elevating overall NOI. By exploring diverse income streams, property owners can ensure financial resilience and long-term profitability in the competitive real estate market.

Smart Marketing and Tenant Retention

Strategic marketing and tenant retention efforts play a crucial role in boosting rental income and NOI. Implementing effective marketing strategies, building strong tenant relationships, and minimizing turnover through incentives contribute to sustained rental income.

Happy, long-term tenants not only reduce vacancies but also enhance the property’s reputation, attracting new renters. By prioritizing tenant satisfaction and employing smart marketing techniques, landlords can fortify NOI, ensuring consistent financial growth in the competitive real estate landscape.

Leveraging Technology for Efficiency

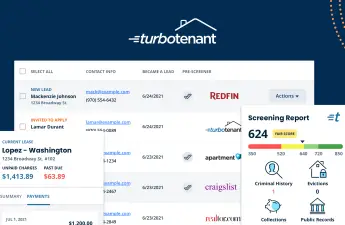

Property owners can boost NOI by harnessing technology to streamline operations. Implementing property management software, utilizing online rent payment platforms, and integrating smart home technologies enhance efficiency. Automated processes reduce administrative burdens, minimize errors, and improve overall tenant satisfaction.

Embracing technology not only optimizes property management but also positions the investment for sustained financial success by increasing NOI in the competitive real estate market.

Negotiating Higher Rent

Not sure how to increase rent? Negotiating higher rent demands a delicate approach to avoid tenant alienation.

- Begin by thoroughly assessing local market conditions to ensure any proposed increase aligns with current rates.

- Showcase the property’s value through amenities, upgrades, or unique features that enhance the tenant experience.

- Clearly communicate these enhancements to illustrate the justification for a rent adjustment, fostering understanding and buy-in from tenants.

- Offer transparency in the negotiation process, explaining the reasons behind the increase and addressing any concerns.

Balancing market awareness, value demonstration, and open communication ensures a collaborative approach, promoting a positive landlord-tenant relationship while successfully negotiating higher rent.

Monitoring Market Trends

Staying informed about market trends is vital for maximizing rental property income due to its direct impact on property value and financial performance. Adapting to market changes allows property owners to align rental rates with current demand, ensuring competitiveness in attracting tenants.

Understanding trends in tenant preferences, neighborhood developments, and broader economic shifts enables proactive decision-making. It empowers property owners to strategically position their rentals in the market, adjusting offerings and pricing to reflect the evolving landscape.

By monitoring market trends, landlords can capitalize on opportunities, mitigate risks, and ultimately optimize rental property income, fostering long-term financial success in the dynamic real estate environment.

![]() Also Read: The Best Rental Estimates for Your Property

Also Read: The Best Rental Estimates for Your Property

Landlord Gurus Takeaway

For property owners aiming to increase NOI and boost rental property income, using tools like a net operating income calculator provides a clear financial picture. Make strategic rent adjustments, offer extra services, and enhance the property to attract satisfied tenants. Also, consider diversifying income sources and embracing technology for efficiency.

Effective marketing, tenant retention, and clear communication are essential for positive landlord-tenant relationships. Stay informed about market trends to remain competitive. Combining these steps forms a simple yet powerful strategy to increase overall property profitability and ensure long-term financial success.

Disclosure: Some of the links in this post are affiliate links and Landlord Gurus may earn a commission. Our mission remains to provide valuable resources and information that helps landlords manage their rental properties efficiently and profitably. We link to these companies and their products because of their quality, not because of the commission.

good stuff