OK, so you’re wondering whether buying a rental property is a wise investment for you personally. Here are the factors we believe you should consider before you even start looking. Below is a brief rundown. See the complete episode for more information.

What Are You Trying to Accomplish?

Rental real estate can serve a range of different purposes, and it is a good idea to be clear about what your objectives are before taking the plunge. Having this information will also inform how you choose the property you choose to invest in.

Here are some of the common goals people have when deciding to invest in rental real estate:

1. Generating earnings by buying, improving, and selling. Aka “flipping” houses.

- This isn’t our wheelhouse, though we successfully flipped a house in 2007 by doing a complete remodel and addition.

- Done successfully, flipping houses can build wealth quickly, however it carries higher risks and isn’t our cup of tea.

2. Produce positive cashflow from the outset.

- This generally requires investing a large amount of capital up front, so that lending costs are low. Otherwise you would have to be a very smart, and probably lucky, buyer.

- Another approach is to strategically rehab or improve a property. It is often possible to purchase a rental that is run down at a better value than one that is in good shape and performing well. Not everyone can or will want to take on a project, which narrows down the competition. Improvements will need to be chosen carefully so that each dollar you spend increases the rent you can charge by the maximum amount. Taking this approach a step further is often referred to as BRRR – buy, rehab, rent, refi.

- We’ll do another video down the road on upgrades that make the biggest impact.

3. Create future “passive” income.

- This is a common and very practical approach to preparing for retirement or financial freedom later in life.

- Finding a rental in a market that is growing can lead to positive cashflow down the road.

- Obviously it would be best for the property to at least support itself financially right off the bat, but it can sometimes make sense to be cashflow negative for the short term if you’re confident that the profitability will improve over time.

4. Short term hold

- By short time we are talking about holding a property for only a few years.

- This approach could be speculative, based on anticipated appreciation in the market. This carries more risk than we like, however if you’re in the position to hold until it makes sense to sell then you can mitigate that downside.

- Rehabbing or improving is a good approach, where you add value to a property and can sell for more than you put into it.

5. Long term hold

- This is the model we are most familiar and comfortable with.

- Obviously these properties would need to be cashflow positive in order to make sense.

- This approach usually overlaps with the passive income strategy, however, you might go into a rental real estate investment planning to sell the asset in the future.

6. Create generational wealth.

7. Diversify investment portfolio.

How Much Money Will You Need?

Here are some things to look at when deciding whether you have the resources to invest in a rental property.

1. Look at the cash you have available, leaving reserves in case of emergencies. (They happen!)

2. Research the properties that are available in your target market. For properties under 4 units lenders are generally asking for a 20% down payment. Financing properties over 4 units is treated entirely differently from regular residential lending. Qualifying is generally more difficult, and rates are often higher. Look into borrowing costs and your eligibility.

3. Research market rents by looking at comparable units on rental listing sites. There are also many rent analysis tools available, some even for free.

4. Evaluate whether you are able and/or willing to make improvements to a property you’ve just purchased. If so, do a realistic budget and examine what your purchase and remodel costs will be.

5. Decide whether your investment needs to be cashflow positive from the beginning or whether you are willing and able to put money into covering the monthly expenses for a while.

What Expenses Will You Face Once You’ve Chosen a Rental?

This is important when evaluating the purchase of rental real estate. We will do a separate video and article on how to pick a rental property, but for now here are some of the common operating expenses:

1. Will you hire a property manager? This cost 8-12% of monthly gross rents, on average.

2. Utilities – Look at which utilities are separately metered and which you can feasibly charge to tenants.

3. Landlord insurance

4. Property taxes

5. Financing costs, if applicable

6. Upkeep of the premises – make sure you carefully account for all of the expenses that go with each property.

- Yard care

- Pool

- Routine maintenance: seasonal cleanup, gutter cleaning, etc.

- Common area cleaning

7. Registration and inspection fees

What Kinds of Skills and How Much Time Do You Need to Manage a Rental Property?

We put “passive” in quotation marks earlier, for a reason. Owning rental property involves work, though it is highly dependent on its’ nature, size, condition, and location. Hiring a property manager will take much of this burden off your shoulders, but comes at a significant expense.

Here is a broad overview of the tasks that go into property management:

1. Finding tenants

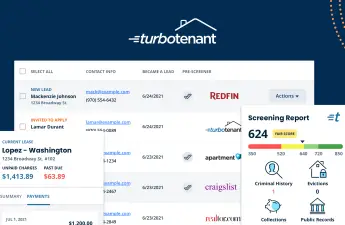

- Putting together advertisements with appealing descriptions and attractive photos. Most renters are searching for their new homes on online listing sites, so comfort with the internet is required.

- Responding to inquiries and scheduling viewings.

- Showing the unit, which can often be in the evenings or on weekends.

- Reviewing applications and screening reports, and calling references.

2. Staying on top of documentation – this includes lease renewals, notices, and requirements you locality may have.

3. Staying up on local rules, regulations, and required inspections

4. Managing maintenance and repairs

- Are you going to make repairs and perform routine maintenance yourself? Do you have the time, and the flexibility to do this work when it come up?

- Having reliable vendors, especially handy people, can reduce the burden of property upkeep, however, it drives up the cost!

5. Bookkeeping – You are operating a small business. Income, expenses, and write-offs will all need to be tracked and reported. There will be additional expense if you are hiring an accountant to do your taxes, above and beyond the cost of preparing your personal tax return.

Our Takeaway

We hope this helps you in deciding whether buying a rental property is a good move for you. Needless to say, we believe it’s a great way to invest, as do other investors according to this survey.

If you decide to purchase rental property there are lots of tools available to help you do so profitably and smoothly. We have written about these extensively on the site, in addition to sharing the tips and tricks we’ve learned over the years.

Landlording A-Z Series:

Our Landlording A-Z series will walk you through each of the stages, tasks, and issues involved in rental real estate investing. In our next installment, we will move on to choosing a specific property that fits your needs and objectives.

Disclosure: Some of the links in this post are affiliate links and Landlord Gurus may earn a commission. Our mission remains to provide valuable resources and information that helps landlords manage their rental properties efficiently and profitably. We link to these companies and their products because of their quality, not because of the commission.