Investing in real estate has been a proven investment strategy for decades. But with rising interest rates, is rental property a good investment? The answer is YES, but it is becoming more important than ever to make sure you select the right property.

Before you decide whether to buy a property or not, put in the time and effort to research the market and then make the right choice. Keep in mind that as real estate markets typically move through cycles, you may have to buy and hold property as a long-term investment to be able to generate high returns on investment.

Along with the potential to earn income through renting as well as long-term appreciation, investing in rental property also gives you the opportunity for tax benefits, such as deductions for operating expenses, mortgage interest, property taxes, and depreciation reducing pre-tax net income. However, you can only fully reap these benefits if you make the right investment.

In this article, you’ll learn how to find and analyze a good real estate investment. Plus, we’ll also share tips on how to become an effective landlord to maximize your earnings.

How to Invest in Rental Properties

Investing in rental property can be lucrative, but it can come with many challenges. Here are a few things you need to consider before you invest in a rental property.

1. Pay Off Debt

Before you jump into purchasing a rental property, consider repaying all sorts of personal debt, including student loans or unpaid medical bills. However, you may still invest in real estate if the expected return from the investment is greater than the cost of debt. The key is to avoid putting yourself in a position where you lack the cash to make payments on your loan.

2. Location

Choosing the right location is important for a profitable investment. Ideally, you’ll find a location with low property taxes, easy access to public transportation, a low crime rate, a decent school district, a growing job market, and plenty of amenities like restaurants, cafes, malls, and parks. Most renters want these amenities within a 5 to 10-minute drive. So if your property is located within a few miles of most of these amenities, it will help you earn better rent as well as raise your property value.

3. Secure a Down Payment

Typically, investment properties need a larger down payment than owner-occupied properties do. As a result, they have stricter approval requirements. For real estate investments, you will usually need at least a 25% down payment, or more. This can come from your savings or equity from your existing house. Even if you don’t have a full 25% deposit, it’s possible to obtain the down payment through various forms of financing, such as a personal loan.

How to Analyze Rental Property

Analyzing a rental property, projecting its potential performance, and determining whether it’ll make a good investment are all critical steps. It’s also important to have precise cash flow estimates and valuation projections. Luckily, modern technology has made it possible to analyze potential rentals within seconds right from your smartphone.

The three common ways you can analyze a rental property are:

1. Learn the Metrics

Is rental property a good investment? To be able to answer this question, you need to know what metrics to use to analyze a property. With the help of the right tools, you can easily determine whether a rental property is a smart investment.

When buying a new property, some of the important metrics that you need to calculate are:

- Capitalization Rate (Cap Rate), Net Operating Income (NOI), and Gross Rent Multiplier (GRM) – Determine whether or not the investment is a smart choice.

- Internal Rate of Return (IRR) – Estimate when and how much income a property is likely to generate.

- Return on Investment (ROI) – Determine how much increase in wealth an investment is likely to bring you.

- Debt Service Coverage Ratio (DSCR) – Analyze your ability to make the payments when taking out a loan for an investment property.

If you already have an investment property, Cash-on-Cash (CoC), Operating Expense Ratio (OER), and Return on Investment (ROI) are great tools to evaluate how well your properties are making you money.

2. Use Calculators

These rental property calculators are particularly valuable for beginner real estate investors who don’t know how to calculate metrics that will help them make the best decisions.

With these calculators, you can calculate all of the above-mentioned metrics to analyze a new property as well as the health of your existing properties. You can obtain a better understanding of your real estate business whether you’re new to property investing or a seasoned professional.

3. Use DealCheck to Analyze Rental Property

DealCheck is a property analysis tool that helps you analyze rentals, flips, rehab projects, multi-family, and commercial deals. You can use it to calculate potential cash flow, investment returns, total profit after the sale, and many other financial metrics that are important when evaluating potential rental properties.

You can also compare different properties in the same area and explore their average listed rents to find the best real estate deals. Moreover, it helps you calculate the highest price you can offer on a property through its Purchase Offer Calculator which uses reverse valuation to work backward from your target criteria.

DealCheck’s starter plan is free and allows you to save data of up to 15 properties and compare up to five properties. With its premium packages, you can save more properties as well as access additional features. Use promo code GURUS to enjoy 20% off your subscription.

Becoming a Landlord

Buying rental properties is often quite challenging. The process involves dozens of steps, and you have to make several key decisions before a successful purchase. Often you must buy and hold property long-term to reap cash flow and property appreciation.

Before you purchase your first rental property, ask yourself whether you can appropriately manage such a business. Becoming a landlord isn’t easy.

Rental property management can be cumbersome and laborious, particularly if you have another job. Plus, there are added responsibilities of being a landlord such as maintaining the property, finding good tenants, and more. While you can hire a property manager, it can be expensive and cut into investment returns.

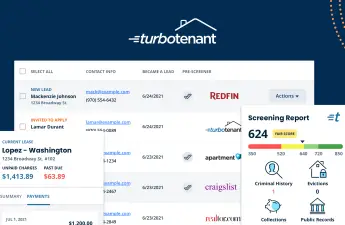

Luckily, you can always learn the best tips and practices for free here at Landlord Gurus. Also, explore which tools you should use to streamline processes and make your life easier. There are plenty of property management tools on the market that can help you simplify property management – from advertising and applications to tenant screening, lease signing, rent collection, and more.

Landlord Guru’s Takeaway: Is Rental Property a Good Investment?

Analyzing potential rental properties is a crucial step in helping you choose the most profitable investment. However, it doesn’t have to take hours and involve complicated spreadsheets to get it done right.

We recommend learning the right metrics, using our rental property calculators, as well as using DealCheck to analyze a new property before investing your money in it. And once you purchase the property, take advantage of the several property management software tools to simplify the process of property management. Check out our overview of property management software to decide which product fits your needs.

Disclosure: Some of the links in this post are affiliate links and Landlord Gurus may earn a commission. Our mission remains to provide valuable resources and information that helps landlords manage their rental properties efficiently and profitably. We link to these companies and their products because of their quality, not because of the commission.