Financial freedom can be achieved in many ways, but one of the most resilient and lucrative ways is by owning rental real estate. If you take a close look at the wealthiest in the world – or the most financially free people in your network – you’ll notice they all have one thing in common: a portfolio of real estate investments. Of those investments, an increasing number are single-family homes that they’ve turned into rentals (SFRs).

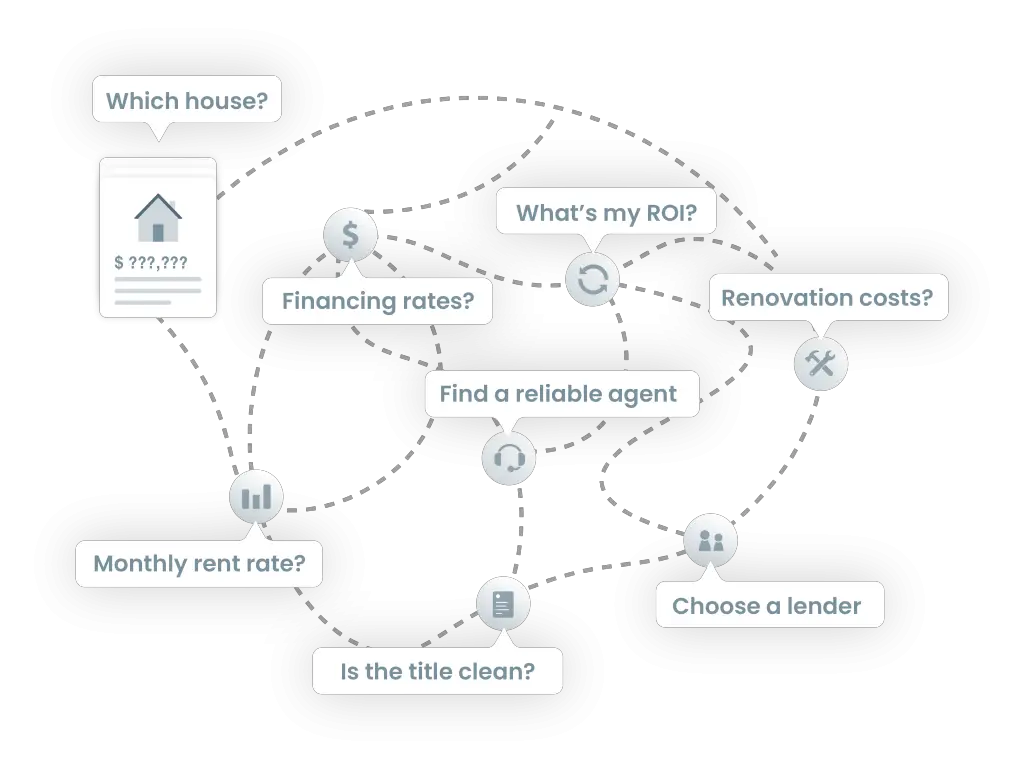

SFRs are one of the most lucrative and stable investments on a risk-adjusted basis, but investing in them can be an intimidating process if you have little experience and no guidance. In this article, we introduce you to SHARE: the easiest way to build a portfolio of rental properties.

What is SHARE?

SHARE is a creative solution to overcome common barriers to real estate investing. It’s a completely digital and remote way of owning and building a portfolio of high-yield, turnkey single-family rental homes that are professionally managed. With SHARE, you can be a landlord without any landlord duties.

How does SHARE work?

Backed by the same investors of Airbnb, Robinhood, SoFi and more, SHARE is a team of asset management experts with decades of experience in acquisitions and estate planning. They know what it takes to be successful in this space, so each step of the process is carefully planned to offer investors a headache and hassle-free experience:

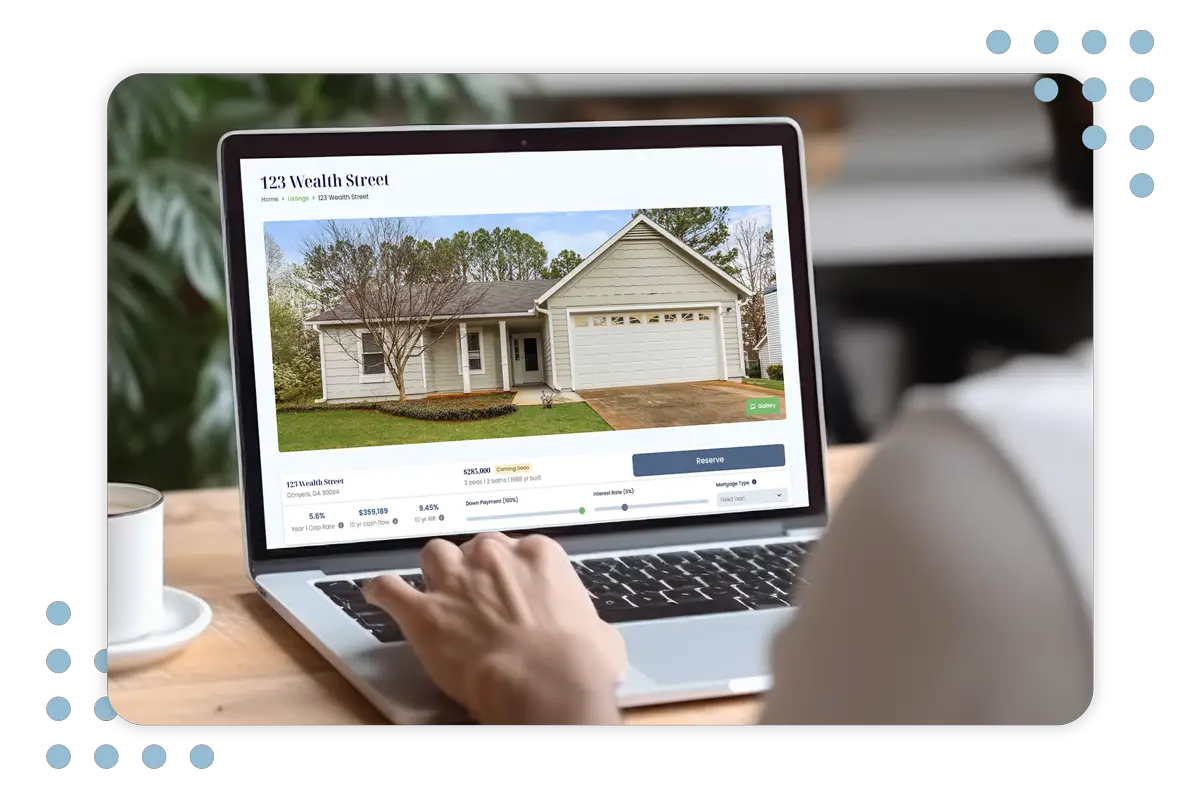

- Sourcing customized on and off-market deals: SHARE has the ability to curate a list of investment properties that suit an investors’ investment criteria. Each listing is equipped with in-depth projected returns and proformas so investors do not have to calculate potential returns themselves.

- Thorough assessments to meet the highest standards: SHARE professionally inspects each property prior to listing to establish a projected renovation, repairs, and maintenance budget. Renovations are recommended to maximize rental income returns.

- Dedicated closing team: Their Client Success Team works with investors at every step of the way to ensure an efficient close. You won’t be navigating any step alone!

- Quality renovations: Once you close on the property, SHARE will oversee the execution of quality renovations within the established projected budget.

- De-risked & stabilized: SHARE offers their investors 3-months of guaranteed rental income, plus free repairs for your first 12-months of ownership.

- Matching with a professional property manager: SHARE will help tenant the property with the highest quality tenant and lease at the highest monthly rental rate based on the market.

- Institutional-grade asset management: SHARE handles all operations on your behalf while helping you grow your portfolio.

What’s the catch?

There’s no catch – only transparent fees that have already been factored into their financial calculators and pro-formas for each property listing.

3.00% acquisition fee or $7,500

- They charge the greater of the 2 at the time of close on the purchase price.

0.25% – 1.00% asset management fee*

- This is an annual charge (collected monthly) based on the original purchase price (subject to a maximum 3% annual adjustment).

- Only deducted when rents are collected.

Are you ready to take the next step?

- Search: Create a free account to browse the various homes listed on SHARE with different return profiles. By signing up, you get direct access to their Client Success Team so you can start your search with them very quickly.

- Close: Their Client Success Team works closely with you on every step of closing so you can take ownership in <45 days.

- Collect: Let the wealth creation begin! After you take ownership, you’ll get access to the SHARE portal where you will find in-depth reporting on your portfolio. SHARE handles all of the property operations and continuously looks for growth and liquidity levers on your behalf.

Landlord Gurus Takeaway:

SHARE properties are professionally vetted and de-risked so you can start or grow your real estate portfolio without the headaches of searching for the right property (especially in new markets), or the guesswork of calculating rental yields and capital returns. Plus, SHARE allows you to be a landlord without any of the landlord duties. It’s a great solution for investors of all types, for all stages, and for diversifying your portfolio.

You can learn more about SHARE and get started here.

Disclosure: Some of the links in this post are affiliate links and Landlord Gurus may earn a commission. Our mission remains to provide valuable resources and information that helps landlords manage their rental properties efficiently and profitably. We link to these companies and their products because of their quality, not because of the commission.