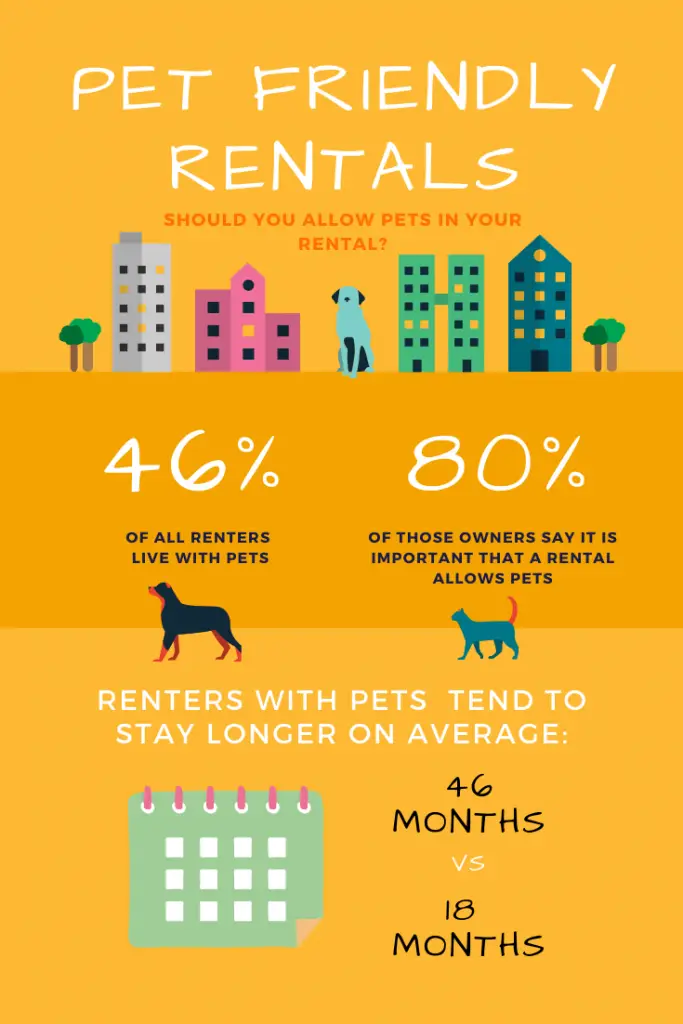

According to the 2019-2020 National Pet Owners Survey conducted by the American Pet Products Association (APPA), 67% of American households (about 85 million families) own a pet. In a 2019 study Firepaw.org found that nearly 50% of renters own a pet. Landlords have millions of reasons to consider allowing animals in their units, but must protect their interests by carefully picking the best pet fee for rental property.

Today, more and more renters have or want to have pets, which is why many landlords are thinking about allowing pets in their rentals. We all know that filling vacancies quickly is one of the most important aspects of running rental investment profitably. With a carefully crafted pet policy applicant pools are likely to be larger, and pet fees or pet rent can add to revenue.

Related Read: The Best Tenant Screening Service for Small Landlords

At the same time, landlords are striving to avoid some of the potential problems of allowing pets, such as the potential for damage and disruptive or aggressive behavior.

What are pet fees? Pet deposits? Pet Rent? We’ll look at the pros and cons of each and suggest strategies for choosing the best pet fee for rental property.

Pet Fee vs Pet Rent vs Pet Deposit

As a landlord, you can charge pet rent, a pet deposit, or an up-front pet fee for rental to cover any damages to your property caused by pets. By definition fees are non-refundable, while deposits are held in case of unpaid liabilities. They are always refundable, assuming there are no repairs required or debts remaining. Note: Always check your local regulations to make sure you know which pet fees for rentals are allowed.

Let’s take a look at each of these options.

Pet Fees

A pet fee for rental is a nonrefundable payment beginning of a tenancy. The premise is that landlords are extending a special privilege to tenants with pets, and that there is a basic understanding that pets are generally hard on properties. A pet fee compensates the property owner for taking the risk of allowing animals in the rental. Some landlords charge per-pet, or by the size or species of the animal.

Pros

- You get money up-front and it is not refundable. If there is no damage, then this is increased revenue.

- Money in hand now, for sure, is better than having to chase tenants to reimburse you for repairs later.

- If you discover animals have impacted your property after you’ve refunded any deposits, at least you’ll have the pet fee you’ve already collected to help pay for repairs.

Cons

- The amount you charge may not cover all the damage caused by pets.

- Charging a pet fee may raise a barrier to filling your vacancy quickly. No one likes to fork over money they will never get back, and many times tenants believe – and will try to convince you – that their animals won’t have any negative impact on your property.

- Many states, including California, do not allow collecting nonrefundable pet fees from renters.

Related Read: How To Screen Tenants in 7 Easy Steps

Pet Deposits

A pet deposit is a refundable payment collected at the beginning of a lease. If upon the move-out inspection you find that there is no pet damage, you will have to return the amount in full. Pet deposits can cover issues such as:

- Animal hair and odors, especially in carpets and blinds

- Pest infestations

- Scratches on doors or floors

- Chewed baseboards

- Urine stains

Pros

- In case of serious pet damages, you have funds in reserve.

- Due to its refundable nature, renters are more likely to be willing to pay it upfront.

- As a refundable deposit is attractive to renters, it can increase your pool of potential applicants.

Cons

- Pet deposits can be tricky from a legal perspective because of the specific local rules that landlords must follow.

- A deposit that’s collected specifically to cover a pet’s impact usually cannot be used to cover other expenses.

- If there’s no pet-related property damage, you will have to return the amount in full.

Eli’s Anecdote: In the first rental I ever bought, a fixer triplex in Portland OR, I had one renter who stayed-on for a few years after we took ownership. At one point I discovered that she’d moved a kitten into the apartment without asking me. I informed her that she couldn’t keep the cat and she moved out not long after that, for a combination of reasons. When I removed the old carpets I found beautiful old narrow-strip oak flooring… and pee stains. I hired a company to refinish the floors, but found out as soon as they started sanding that it was impossible to remove the urine smell. Ultimately I had to put down new engineered flooring. This experience reinforced how important it is to collect adequate pet fee for rentals, so that I don’t have to pay for animal damage out-of-pocket.

Pet Rent

Pet rent is a monthly fee that you charge for pets on top of regular rent. Renters often see this as the most palatable fee for rental properties, as the monthly amount is usually modest and the overall cost is spread over a long time.

Pros

- Pet rent increases the money landlords can collect for the risk of allowing pets in their rentals. Allowable pet fees and deposits are often limited, so pet fees give landlords a way to increase the rewards and offset the risks of allowing pets in rentals. Pet rent is guaranteed income, whether there is damage or not.

- It’s an attractive option for renters with pets as it doesn’t overburden them with a big upfront payment.

- It supplements the monthly income of landlords.

Cons

- Choosing the amount to charge in pet rent is a tricky balance. Charging too much may make for unhappy tenants over time. Charging too little may leave landlords with inadequate insurance against animal-related repairs.

Related Read: Residential Lease Agreements: Best Software for Small Landlords

Rules Regarding Pet Deposit, Pet Rent, and Pet Fee for Rental Property

As we often do, let’s use Seattle as an example as it is a city that is on the frontier of restrictive rental laws. Regulations passed here, and in many other West Coast cities, often get adopted in other markets not long afterwards.

How Much Can I Charge In Pet Fees?

In Seattle, landlords are not allowed to charge nonrefundable pet fees. However, in other cities, typical pet fees may range from $100 to $300, depending on the local and state laws. In most places the amount of pet fee a landlord can charge has no formal limit, the question is how much tenants are willing to pay.

How Much Pet Deposit Can I Charge?

According to Seattle’s tenant-landlord laws, the pet deposit should be no more than 25% of the first month’s rent. For instance, if the monthly rent is $1,000, you may charge $250 as a pet deposit. The average pet deposit in Seattle is $266. Also, only one pet deposit may be held per household, no matter how many pets are kept. However, you may limit the number of pets allowed on your property. In other locations pet deposits are generally $250-500.

How Much Pet Rent Can I Charge?

You may calculate the amount as a percentage of unit rent, or charge a flat rate depending on number of pets, market area, pet size, or your experience with pets on the rental property. Usually, pet rent is in the range of $25 to $50 per month. According to Trulia’s research, the average pet rent in Seattle is $32.

Related Read: The Best Online Rent Payment Service for Small Landlords

Pet Ownership in U.S. Households

| Species Of Pets In U.S. Households | Number in Millions |

| Dog | 63.4 |

| Cat | 42.7 |

| Freshwater Fish | 11.5 |

| Bird | 5.7 |

| “Small Animal” | 5.4 |

| Reptile | 4.5 |

| Horse | 1.6 |

| Saltwater Fish | 1.6 |

Landlord Gurus Recommends: Best Pet Fee for Rental Property

If you decide to allow pets on your rental property, here is what we recommend:

No Up-Front Pet Fee

We recommend against charging an up-front pet fee as it may scare away potentially good tenants. Filling vacancies quickly, with the best tenants, is one of a landlord’s most important tasks!

Reasonable Pet Rent

We recommend charging a reasonable amount of pet rent. Situations vary but we’d suggest around 3-5%.

If it’s reasonable, a tenant will just see it as the cost of having the privilege to have a pet in your rental, as rentals that accept pets are hard to come by.

Pet rent gives the landlord a bit of supplemental income to compensate for the risks of accepting a pet.

Carefully Screen Pets

We recommend screening both applicants and their pets carefully.

Pet screening is a process that helps landlords and property managers to evaluate the suitability of prospective tenants who own pets. It can include verifying the pet’s identity, health records, behavior history, and insurance coverage. Pet Screening can benefit both landlords and tenants by reducing the risk of property damage, liability claims, and conflicts with other residents.

Larger Security Deposit

Charge an increased security deposit. However, don’t call it a “pet deposit” because you can then only use it for damages you can demonstrate were caused by the pet.

Even though it’s a refundable deposit, a larger amount gives landlords flexibility. Pets can cause damage and it’s important to collect a deposit that’s likely to cover fixing anything that happens. On the other hand, all kinds of damage and expenses can be incurred by tenants. Charging an increased security deposit helps cover costs, whether they’re animal-related or not.

We recommend approximately 25% in additional deposit when allowing pets in your rental.

Also Read: The Best Free Property Management Software for Small Landlords in 2021

Sample Scenario

For example, suppose you have a 1-bedroom apartment that goes for $1000/month. Here’s a breakdown of what you might charge.

| Monthly Rent | $1000 |

| Pet Rent @ 5% | $50 |

| Refundable Security Deposit | $1000 |

| Additional Deposit @ 25% | $250 |

Keep in mind that some cities and states limit the amount of total deposit a landlord can collect. For instance, in Seattle, security deposit and fees combined can’t exceed one month’s rent. This includes application and screening fees. You can charge an additional pet deposit (25% of one month’s rent) on top of the security deposit and fees.

Pet Calculator

Want to see how much extra income from pet fees and pet rent? Check out our pet calculator and find out.

Key Takeaway

As a landlord, it’s an important decision whether to allow pets. Choosing the best pet fee for rental property can help you capitalize on the advantages of accepting pets while mitigating the risks. But make sure to check local regulations regarding pet and deposit policies before creating a policy on pet fees for rental property.

Disclosure: Some of the links in this post are affiliate links and Landlord Gurus may earn a commission. Our mission remains to provide valuable resources and information that helps landlords manage their rental properties efficiently and profitably. We link to these companies and their products because of their quality, not because of the commission.