There are approximately 11 million independent (aka “Mom and Pop”) landlords and real estate investors in the United States, owning approximately 50% of the national housing supply.

Despite this sizable market, financial services and technology providers have consistently underserved customers in these areas of expertise.

For far too long, landlords’ and real estate investors have relied on fragmented solutions, spreadsheets, manual processes, and limited data to manage their rental properties.

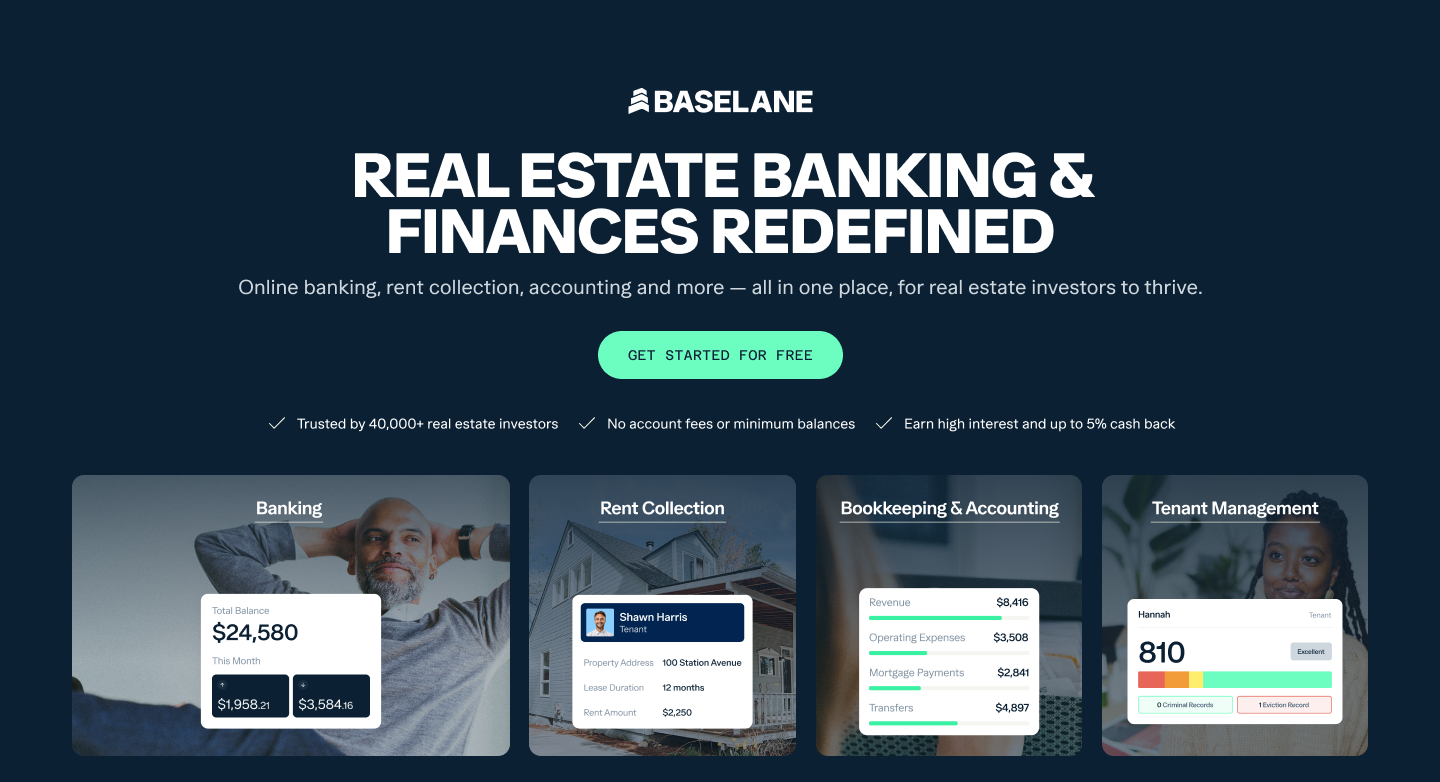

However, new technologies are bridging this gap between property owners and software that makes landlords’ lives easier and saves them time and money. One leader in this space is Baselane, a SaaS platform for property managers and landlords that serves this market by providing an end-to-end financial platform serving the needs of independent landlords and real estate investors.

Real estate investors and landlords using Baselane tend to save time, money, and hassle by managing their daily tasks on a single platform.

Real estate investors and landlords using Baselane can also manage their rental property finances on one platform, such as banking, rent collection, expense management, cash flow analytics, and much more.

In this Baselane review, we provide an overview of the property management software to help if a real estate investor or landlord such as yourself can improve your day-to-day workflow.

What is Baselane? An Overview of the Rental Property Management Software

Baselane is rental property management software that provides an integrated set of tools to help real estate investors and landlords save time and money while increasing their rental property returns.

Tools available through Baselane include:

- Landlord Banking: Baselane allows its clients to open multiple banking and customer accounts to keep expenses organized and funds separated. For example, one of the unique features to help customers accomplish this includes a dedicated virtual account for security deposits.

- Automated Rent Collection: Baselane provides automated rent collection services, allowing your tenants to make payments via ACH or debit or credit card, with a dedicated Tenant Portal for lease and payment management.

- Income and Expenses Tracking: Landlords and real estate investors can track income and expenses by Schedule E category and property by connecting their bank accounts. The software also allows cash flow management and insights around revenue and costs.

- Reporting and Analytics: This Baselane feature includes rent ledgers, cash flow statements, income statements, individual unit progress reports, properties, or portfolios.

Baselane Features & Benefits

Baselane has several additional features and benefits that can greatly improve the efficiency of the way landlords or real estate investors complete work.

Below, we’ll look at what these products are and how they can improve the way landlords do business.

Landlord Banking

Baselane’s recently launched Landlord Banking feature allows landlords to open and manage banking accounts tailored to the specific needs of their investment properties.

![]() Also Read: Landlord Banking: Landlord Gurus Experience

Also Read: Landlord Banking: Landlord Gurus Experience

Baselane Landlord Banking features include

- Free banking account with no account fees, no minimum balance

- Interest yields that are 55 times the national average on all deposits, even on security deposits. Click here for current APY.

- Integration with bookkeeping, reporting, analytics and rent collection

- Operating account for each property, partitioned for each unit, with dedicated accounts for security deposits

- Debit cards with smart controls that enable the cardholders to control and manage their expenses

Rent Collection

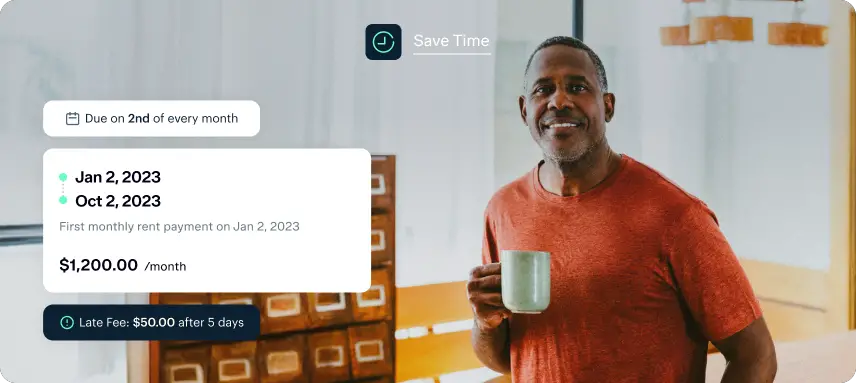

Baselane allows tenants to conveniently pay rent online by signing up in less than five minutes. Within the platform, landlords can collect rent, fees, and security deposits directly to their bank accounts. Tenants can make one-time payments or set up the auto-pay feature from any device.

Key Rent Collection features include

- Accept rent by ACH, debit, or credit card for prompt tenant payment

- Automate payments, fees, and reminders

- Receive monthly rent directly into your bank account, give tenants the flexibility to use the payment method of their choice, and easily keep track of all your payments

- Ability to add one-time fees as needed with the click of a button, such as security deposit, cleaning, pet, parking, and more, with invoices auto-generated for tenants

Bookkeeping and Expense Management

Real estate investors and landlords often have difficulties dealing with expense management and tax preparation.

Baselane aims to reduce the time spent organizing finances with its automated bookkeeping and expense categorization.

Bookkeeping and Expense Management features include

- A simple, consolidated ledger for all your property transactions

- Simple single-click categorization with Schedule E and property tags makes tax seasons less stressful

- Batch tagging makes set up quick and easy

- Integration with Baselane banking account or external banks and credit cards to stay on top of finances in one place

- Flexibility to manage each transaction to manually add, hide or split transactions, or even leave some notes

Reporting & Analytics

Baselane’s reporting provides all the dashboards and tools you need to analyze your cash flow, track your expenses, and understand your performance on a property or unit level.

Reporting features include

- Total cash flow control with all your revenues and expenses for your properties in one place to get visibility on month-over-month performance

- Insights about expenses and the ability to drill into the details of your expenses by category and property

- Automated income statement by portfolio, property or unit

- Easily track Schedule E deductions and identify savings in real-time

- Get automated insights into your property performance, from net cash flow to core real estate metrics, including cap rate, ROE, and cash-on-cash return

- Rent rolls that summarize active leases and key unit-level details, giving you an overview of occupancy rent amounts and lease terms.

- Tenant ledger that gives a detailed history of tenant charges, payments, and balances—organized by property and tenant for tracking rent and fees. You can also share it directly with tenants to comply with transparency rules in regulated states.

Finally, Baselane brings all these financial reports into a single, unified dashboard with built-in contextual summaries to make them easier to read, understand, and export (CSV, PDF, XLSX).

Tenant Screening

As a landlord, you want to avoid renting to tenants who have a high chance of not paying rent, damaging your property, or requiring an eviction. According to TransUnion, the average eviction costs $3,500 and can take 3-4 weeks.

Baselane lets you screen tenants to avoid problematic tenants. Their basic tenant screening option costs $24.99 (charged to tenants) and includes:

- Self-reported information on income, housing history, dependents, pets, vehicles, smoking, and more

- ID verification

- Equifax credit report

In addition, you can require tenants to agree to the following add-ons (paid for by tenants):

- Criminal report ($5)

- Eviction report ($10)

- Income verification ($10)

Together, all of the above constitute a comprehensive background check that can give you more confidence in a tenant before signing a lease.

Lease Creation & eSigning

Creating and maintaining strong leases can minimize potential disputes and protect you from legal liabilities. With Baselane, you can create state-specific leases powered by Rocket Lawyer and have tenants e-sign them for $10 per lease.

Alternatively, you can upload your own leases and send them to tenants for their e-signatures for $5 per lease, or you can upload and store leases without e-signatures for free.

Pricing

Baselane is free to use, but the platform offers paid tier plans with additional premium features. The app’s business model bases itself on partnerships in its marketplace.

For example, Baselane works with a third-party insurance provider known as Obie.

Landlords

- Free Rent Collection, Bookkeeping, Banking

- Banking Fees:

- No fees for ACH transfers

- No minimum balances

- No monthly fees

- No overdraft fees

- $15 fee for wire transfer (send + receive)

Tenants

- ACH Payments are free

- Debit/Credit Payments – 2.99% transaction fee (standard for industry)

Learn More About Baselane’s Rental Property Management Software

A comprehensive rental property management software like Baselane gives tech-forward landlords a super easy-to-use platform to save time and money, automate their finances and maximize profits, all at no cost to the customer.

Given the extensive toolkit, exciting planned features, and completely free price point, Baselane is an exceptional choice for landlords who want to simplify their rental finances and focus on scaling their business.

Disclosure: Some of the links in this post are affiliate links and Landlord Gurus may earn a commission. Our mission remains to provide valuable resources and information that helps landlords manage their rental properties efficiently and profitably. We link to these companies and their products because of their quality, not because of the commission.

Hello,

Does Baselane have a timeline for offering Property Management: Integrated Tenant screening, Lease Creation, e-Signing, and more?

Not that we are aware of at this time, sorry