What is FrontLobby?

If you’re a housing provider, you know how crucial monthly rent payments are for the success of your business. Fortunately, there’s a great solution that can help ensure rent is paid on time every month while rewarding your great tenants at the same time: FrontLobby. FrontLobby is at the forefront when it comes to supporting housing providers that have been burdened with unpaid rent from both current and past tenants. The platform offers an easy-to-use solution that helps recover rent debt from former leases, as well as incentives needed to prevent delinquencies from current leases. We looked at what FrontLobby has to offer, so you can decide if it’s the right fit for your needs.

Membership

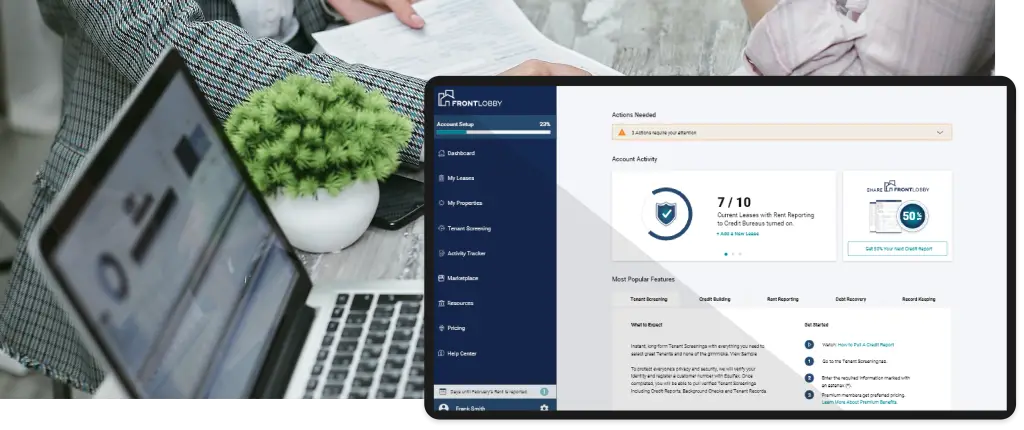

FrontLobby is a web-based platform designed to improve the rental industry for everyone. There is no minimum number of units required, which makes it a good solution for those managing 1 or 5000 units. Property management software is not required since it is a web-based platform. Housing providers have the option of either a basic membership, which comes with free features like record-keeping, or a premium membership which unlocks the platform’s signature feature, rent reporting to the Credit Bureaus. Premium members can choose from an annual membership or 6-month membership and receive substantial discounts on the platform’s a la carte products like tenant screening and debt reporting. There is an enterprise option for larger players, as well as the option for renters looking to access certain benefits. Memberships are available in both the US and Canada.

Competition

The platform claims to be one-of-a-kind, and while there are a few competitors in the space, most cater to renters looking to build their credit by only reporting on-time rent payments. Other companies never share unpaid rent with the Credit Bureaus, providing zero benefits to the housing provider looking to protect their investment. It’s worth noting we did find one other platform specifically for housing providers, but it is reserved for large landlords and property managers with portfolios of 1000+ units.

This is where FrontLobby stands out from the competition. The company takes a balanced data-driven approach, enabling members of all sizes to report both paid and unpaid rent payments to the Credit Bureaus. As a result, renters who pay rent on time receive the benefit of improved credit, while those who miss payments are notified of the negative impact it can have on their credit. FrontLobby’s model is like banks, and credit cards that share both positive and negative payment data with the Credit Bureaus as a means of encouraging consumers to make timely payments.

Rent Reporting Feature

According to a recent survey by FrontLobby, almost half (46%) of housing providers faced late or unpaid rent payments. Additionally, the majority of those surveyed depend on rent for their mortgage payments. FrontLobby’s signature feature, rent reporting to Credit Bureaus, offers an answer to this crisis. The feature enables landlords to share tenants’ monthly rent payments with the Credit Bureaus and makes communicating missed payments easy. An automated email sequence will inform them of the impact it can have on their credit. Depending on the individual’s needs, the emails can be turned on or off. Once shared, the rent payment will appear as a tradeline on the tenant’s credit report and depending on its status will either positively or negatively impact credit. Rent reporting is proven to reduce delinquencies by 95%, according to happy customers.

It’s worth noting that in 2022, Equifax and FrontLobby released a multi-year tradeline study that demonstrated the effectiveness of rent reporting on a credit report.

Debt Reporting Feature

There are few options for housing providers when a tenant moves out and have not paid rent for several months. Debt that is $5000 or more can be sent to a Collections Agency. However, most agencies charge 35-40% of the amount recovered, leaving housing providers with a fraction of what they are owed. Thus, one of FrontLobby’s most innovative features is debt reporting. As the name suggests, it is designed to help housing providers recover rental debt from former leases.

The model is simple and transparent; housing providers report rental debts to the Credit Bureaus for a one-time flat fee paid upfront. The housing provider keeps 100% of what they recoup when the debt is paid. The one-time fee is paid instead of the commission structure collections agencies use. This allows for debts of all sizes to be reported. Typically, collections agencies will only take debts of $5000 or more, since anything under that isn’t worth their time. This specifically helps smaller landlords who don’t want to give up 40% to the collections agency.

Once activated, the debtor receives ongoing notifications informing them of the impact on their credit report and future credit needs. Debts up to 7 years old in the US and 6 years old in Canada can be reported.

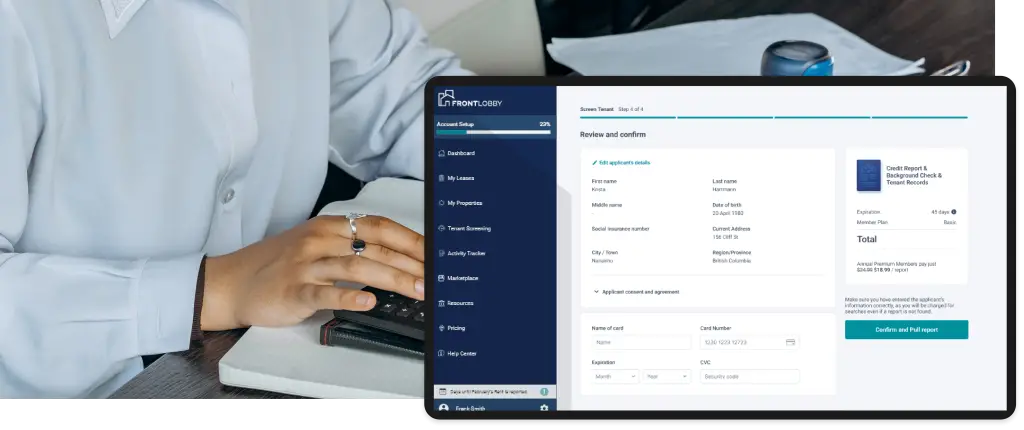

Tenant Screening Feature

It is well-known that proper tenant screening can help housing providers improve tenant relations, reduce delinquencies, and eliminate costly evictions. What most don’t know is that 1 in 8 applications contain some form of fraud. Additionally, 25% of evictions result from application fraud. Landlords and property managers can find great renters using FrontLobby’s tenant screening tools. The platform offers one of the only instant credit checks under $15. For this price, housing providers receive a long-form Equifax credit report that includes scores, current and former addresses, employment confirmation, credit history (tradelines), credit balances, collections, bankruptcies, inquiries, aliases, and verified tenant records. The platform also provides application and lease clauses, screening checklists, and access to save on legal documents.

Record-keeping Feature

One of the perks included with FrontLobby’s basic (free) membership worth mentioning, is its internal record-keeping function. Without a steep learning curve, housing providers can easily keep track of current and past lease agreements, tenant details, and payment records. The tool is designed for internal record-keeping purposes only, but once data is entered, users can easily activate the other features. It is a simple but effective tool for housing providers who are not already using a property management platform.

Limitations

After signing up, don’t be surprised if you are asked to provide your feedback. FrontLobby is always looking for ways to further develop the platform and offer innovative services that meet the needs of its members. We’ve noted a few things we thought FrontLobby could focus on.

- The platform is working on an integration with Yardi, set to be completed in spring 2023. In our opinion, this will make using FrontLobby much easier for landlords and property managers with 5000+ units.

- Even though FrontLobby’s tenant screening is competitively priced, we would like to see the option for housing providers to pass on the cost to applicants. The team let us know that this is in the works, as well as a few other enhancements that will make tenant screening even easier.

Landlord Gurus Takeaway

In certain regions, where laws are heavily skewed in favor of renters, and landlord-tenant boards are backlogged, housing providers have very little recourse when tenants stop paying rent. Costly eviction proceedings averaging $11,000 are not a solid solution, and the stress of having a non-paying tenant can be enough to make you want to get out of the business. In our opinion, FrontLobby is in the business of providing housing providers with peace of mind.

With so many property management tools and tenant screening applications, you’d expect FrontLobby to be more of the same. However, FrontLobby has carved out one of the most painful aspects of being a housing provider and tied it directly to something tenants care about: credit. Now, unpaid rent from both current and former tenants doesn’t only impact those providing the housing. Tenants are held accountable and encouraged to make on-time payments as a credit-building exercise, just like monthly credit card payments.

Conclusions

FrontLobby is committed to making the lives of housing providers a little easier. To get started, the sign-up is quick, free, and gives you access to their marketplace, resources, and other benefits. An upgraded premium membership unlocks access to their signature rent reporting service with 20 leases included for free. While affordability is one of FrontLobby’s main differentiators, a premium membership also grants you additional savings on a la carte purchases like tenant screening and debt reporting.

With FrontLobby, you can improve your relationship with your tenants and reduce the stress that comes with being a housing provider. Utilizing their debt reporting feature, you can more reliably recover the debt you may have from former leases. With tenant screening, you can perform instant tenant credit checks at an affordable price. With rent reporting, you can reward your great tenants and incentivize those with unpaid debts with credit bureau reporting. You’ll stay organized with useful tools like record-keeping, automated tenant communications, and relevant application and lease clauses. In short, FrontLobby helps housing providers spend more time on their investments and less time chasing delinquencies.

>> Sign Up for FrontLobby for Free

Disclosure: Some of the links in this post are affiliate links and Landlord Gurus may earn a commission. Our mission remains to provide valuable resources and information that helps landlords manage their rental properties efficiently and profitably. We link to these companies and their products because of their quality, not because of the commission.

Front Lobby is trash. It takes 120+ days to report to the bureaus for bad tenant debt. They do not report to the bureaus. You can’t dispute the charge after 120 days. They are a foreign company, and your credit card company will charge a foreign transaction fee in tandem.

Front Lobby is a ripoff company. It takes 120+ days to report to the bureaus for bad tenant debt. They do not report to the bureaus. You can’t dispute the charge after 120 days. They are a foreign company, and your credit card company will charge a foreign transaction fee in tandem.