Update: This post has been updated with new winners and rankings based on changes or upgrades to some of the products and services. We have also included new products that have come to our attention since the last update. Read on to see our winners for the best accounting software for landlords in 2023:

Note: As of 4/20/23 Avail’s Unlimited Plus subscription pricing has been updated.

Keeping track of your rental property finances is a time-consuming task that often gets neglected by busy landlords. For example, landlords are often focused on the leasing process, regular or emergency maintenance tasks, rent collection, or even growing their portfolios. Therefore, we might manually input our income and expenses into Excel at best. Or keep a pile of receipts on our desk if we’re not as diligent. Some of us have considered using QuickBooks for our rental properties, but the learning curve is steep and inevitably another more pressing task comes up. As a result, many of us unfortunately focus on our reporting and accounting tools and software only at tax time.

We have previously discussed using property management software to collect rent payments online. Many of the same property management software can also help for both generating useful reports to keep landlords up to date with their rental histories and situations, as well as for their bookkeeping, accounting tools, and tax preparation needs.

![]() Also Read: The Top 6 Benefits of Rental Property Management Software for Small Landlords

Also Read: The Top 6 Benefits of Rental Property Management Software for Small Landlords

The Best Reporting and Accounting Tools For Landlords – Top Picks

We considered the following rental property management software products for the best reporting and accounting tools. Read below for our complete criteria for what you should look for when choosing the bookkeeping and accounting tools for you:

-

Stessa –

Winner: Best Rental Property Accounting Software Overall

Winner: Best Rental Property Accounting Software Overall -

TurboTenant –

Winner: Best Rental Property Accounting Software Add-On (Tie)

Winner: Best Rental Property Accounting Software Add-On (Tie) -

RentRedi –

Winner: Best Rental Property Accounting Software Add-On (Tie)

Winner: Best Rental Property Accounting Software Add-On (Tie) -

Rentec Direct –

Winner: Best Rental Property Tax Prep Tools

Winner: Best Rental Property Tax Prep Tools - Avail – Best All-Around Property Management Platform

- Azibo – Simple and Compliant Accounting, Built for Rental Property Owners

- Baselane – Best Integrated Rental Property Accounting and Landlord Banking

- DoorLoop – Best QuickBooks Integration

- Hemlane – Best Hybrid Property Management Platform

The Best Accounting Software for Landlords: Landlord Gurus Choice

Choosing best accounting service depends on a variety of factors that are most important to you. We describe the 5 key reporting and accounting features that you should consider when choosing the right accounting tool for your properties. We also consider a bonus feature that your tenants may find useful.

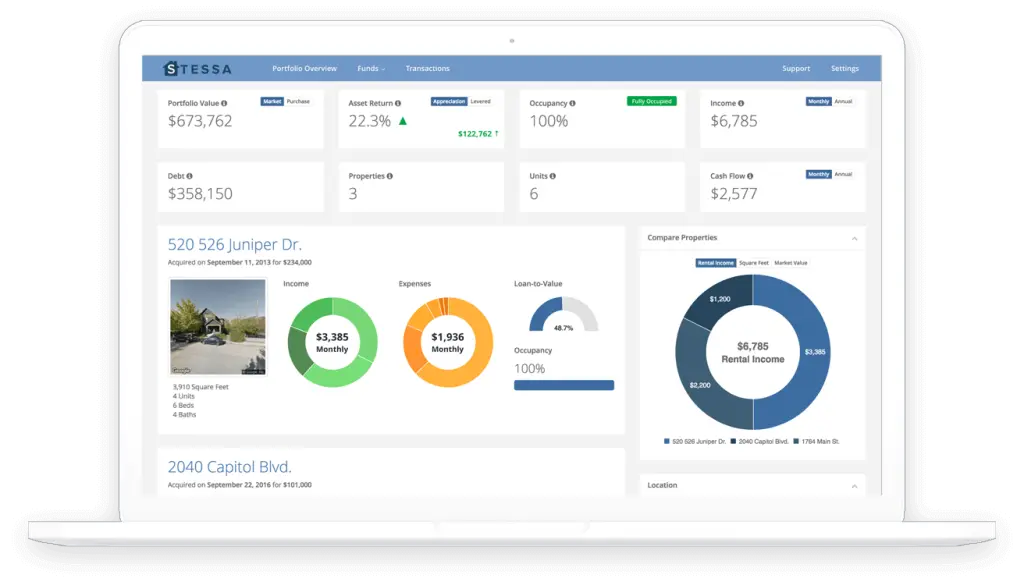

Stessa

Winner: Accounting Software for Landlords – Best Overall

- Asset management and accounting software for real estate investors, including smart money management, automated income and expense tracking, personalized reporting and more.

- Stessa’s real-time dashboards and advanced reports help you own and manage like the pros.

- Stessa imports, categorizes, and indexes all your expenses seamlessly.

- Strength: Accounting and Financial Tracking

Stessa is a smart money management platform that helps landlords and real estate investors optimize their portfolios for performance. Stessa is perfect for landlords and property owners who require easy to use reporting and accounting tools to help take their business to the next level. Link your property information and accounts and gain access to a current view of how your portfolio is performing in real-time. Then within minutes, you can get the insights you need at your fingertips to make better decisions. And best of all, many of these features are free!

Stessa has also recently introduced all-in-one money management with a Stessa Checking account. Now you can streamline your real estate finances with an FDIC-insured checking account that seamlessly integrates with Stessa. Furthermore, get competitive annual percentage yield (APY) rates, no account maintenance fees, and no other hidden fees.

Income and Expense Tracking: Sync your property’s bank and financial accounts with Stessa, and it will automatically track and categorize all income and expenses – including rent payments, expenses, debt payments, capital expenses, and mortgage balances.

You can also track expenses and save receipts on the go with Stessa’s iOS and Android mobile app scanners. Just snap a quick photo and Stessa will automatically create and categorize the transaction for you. Alternatively, forward PDFs via email for automatic processing.

Bank Integration: The first step in setting up your Stessa account is entering your property address and linking bank and other relevant financial and mortgage accounts. Integration is quick, and with Stessa’s bank-grade encryption and strict internal controls, your data is secure. Once complete, Stessa automatically combines all your transactions and categorizes them for easy reporting and tax prep.

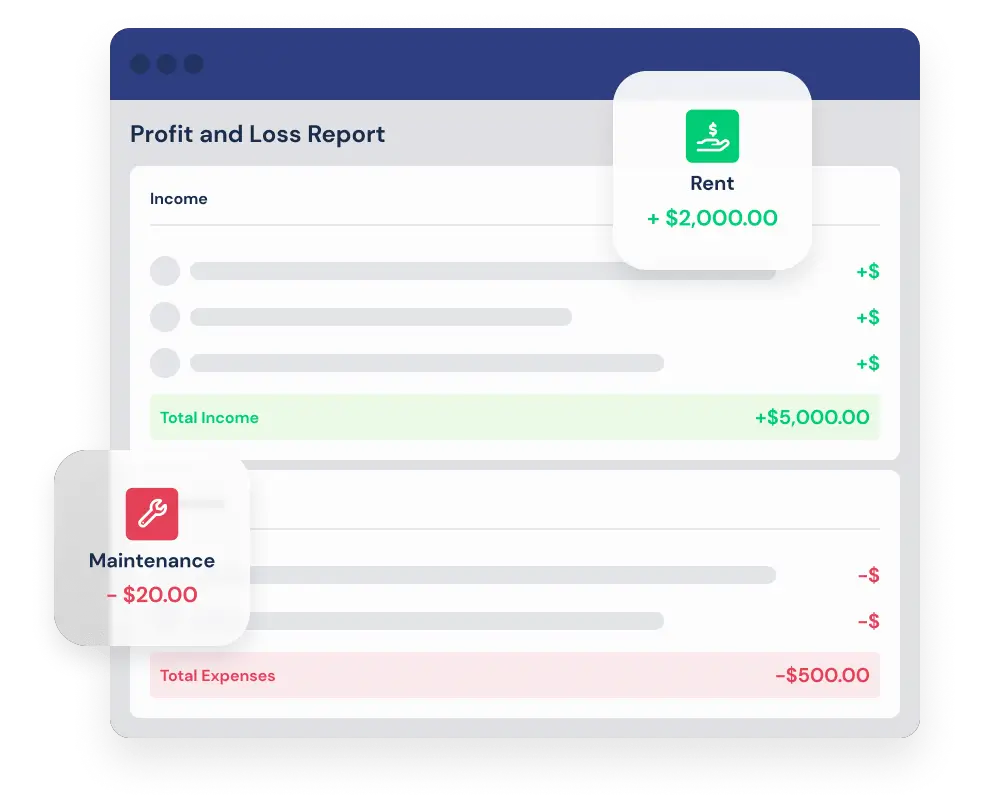

Reporting: With Stessa, landlords can track unlimited properties and run unlimited reports, at both the property and portfolio level, including:

- Income statement

- Net cash flow

- Capital expenses

- Balance sheet

- Stress test model

- Tax package

- and more

Access all your metrics directly from the landlord dashboard, or download Excel or PDF reports to print or share with partners, lenders, CPAs, etc.

Tax Preparation: Stessa makes tax time a breeze with tax-ready financial reports. Export your personalized tax package in seconds and import it directly into TurboTax or share it with your CPA, bookkeeper, or others.

Cost: Stessa is free to get up and running. Save time and maximize returns across your portfolio. Upgrade to their new premium plan to unlock advanced tools such as advanced reporting and tax packages, accelerated rent payments, and more.

Sign Up For a Free Stessa Account

Accounting Software for Landlords: Additional Favorites

While they were not our top choices, TurboTenant, RentRedi, and Rentec Direct all came close. Both TurboTenant and RentRedi offer a robust accounting add-on, and we think Rentec Direct offers some of the best tax preparation tools out of the bunch.

TurboTenant

Winner: Best Rental Property Accounting Software Add-On (Tie)

- Landlord software that simplifies how you self-manage your rental business

- Rent payments from TurboTenant automatically book as revenue on the right property

- Securely sync transactions from your bank account to record expenses quickly and accurately – with no manual entry

- Strength: Complete Solution

TurboTenant is online property management software that empowers independent landlords to:

- Advertise Vacant Units

- Track Leads Automatically

- Accept Online Applications

- Screen Tenants

- Create Lease Agreements

- Collect Rent

- Complete Rental Property Accounting

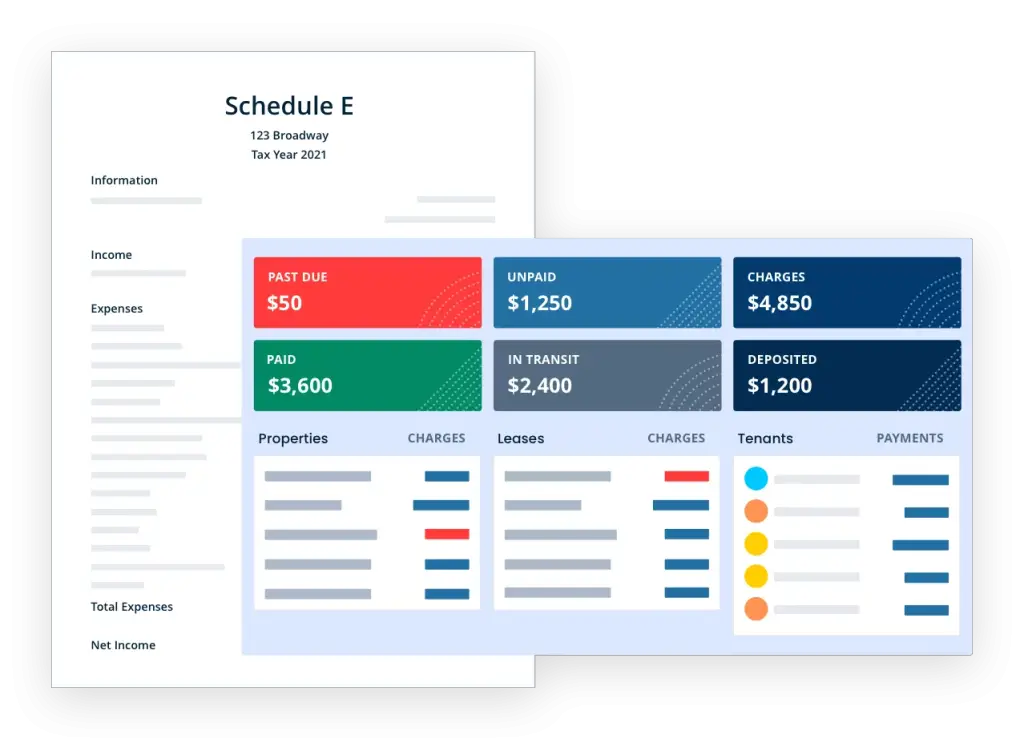

TurboTenant’s recent integration with REI Hub was tailor-made for landlords and their accounts. Rent collection data flows automatically into REI Hub’s system, meaning landlords can get straight to the reports they need faster than ever before, for just $15/month for the first property (and $5/month/property after that). Regardless of the number of units, users will not pay more than $85/month for this extraordinary tool. And currently, TurboTenant users get 50% off their first two months of REI Hub.

Income and Expense Tracking: Rent payments from TurboTenant automatically book as revenue on the right property. Set up rules to automatically categorize transactions like your insurance payments or your favorite maintenance providers.

Bank Integration: Securely sync transactions from your bank account to record expenses quickly and accurately with no manual entry.

Reporting: P&L statements, balance sheets, cash flow are all in your dashboard. You can even download your tax-ready Schedule E report with a single click.

Tax Preparation: TurboTenant will first help you find the deductions you might have missed, and then you’ll get a one-click tax packet with everything you (or your accountant) need to file.

Cost: TurboTenant offers both a free and a premium subscription plan starting at $99/year for their property management software. The accounting add-on starts at $15/month, with 50% off your first two months.

RentRedi

Winner: Best Rental Property Accounting Software Add-On (Tie)

- One dashboard to manage your rentals, receive payments, screen applicants, manage maintenance requests, and list properties

- Automatically sync your RentRedi properties and view your numbers by property or unit

- Get full financial reports as well as tax ready IRS Schedule E reports

- Strength: Complete Solution

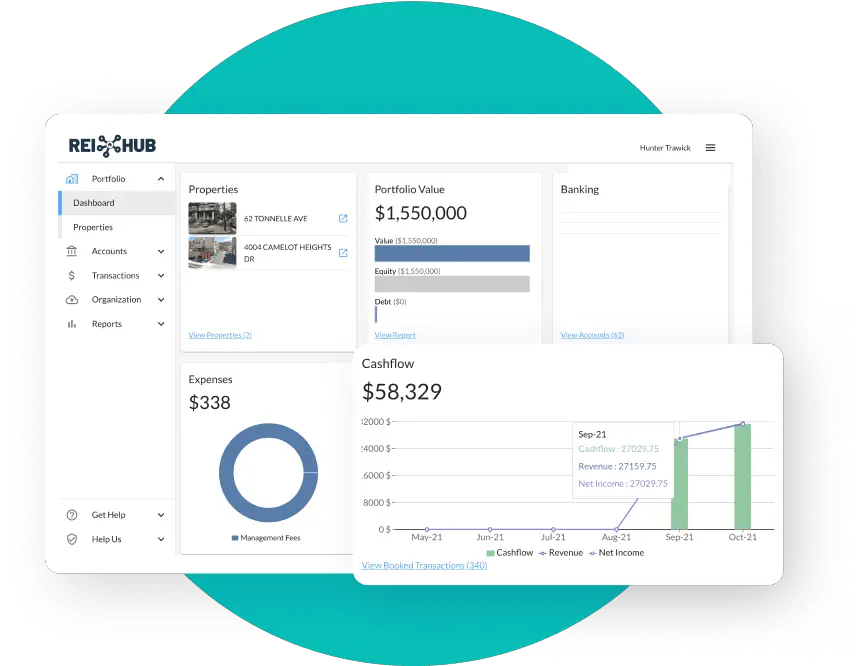

Also performing well in our analysis is RentRedi. With their partnership with REI Hub along with their robust full-featured property management software, RentRedi has managed to combine the best of DIY software tools with an optional rental property-specific accounting and bookkeeping add-on. As a result, we think their accounting tools stack up pretty well against Stessa, and the built-in property management software is an added bonus.

Income and Expense Tracking: RentRedi partners with REI Hub to provide accounting designed specifically for real estate investors & rental property owners. Customers who sign up for the separate accounting features can automatically sync properties & charges from their RentRedi account.

You can also link your bank and credit card accounts for automatic transaction imports. This helps ease bookkeeping and eliminates manual data entry. And take advantage of matching rules and payment templates to accurately track income and expenses.

Bank Integration: RentRedi/REI Hub uses secure data providers (Plaid and Yodlee) to access a read-only transaction feed from your checking, savings, and credit card accounts. They never have access to your sensitive log-in credentials and information.

Reporting: View and understand performance in real-time on your RentRedi portfolio and property dashboards. Access both full financial reports (P&L, cash flow, balance sheet), as well as fixed asset schedules, cash on cash, NOI, and more real estate metrics. There are even integrated lease tracking and mileage log reports available.

Tax Preparation: RentRedi/REI Hub allows landlords to easily pull a Schedule E report for each property with no additional configuration. You can even prorate overhead expenses across your entire portfolio. RentRedi/REI Hub allows you to track your fixed assets, capital expenses and accumulated depreciation.

Cost: While RentRedi’s normal subscription price starts at just $9/month, you must purchase an additional subscription to REI Hub in addition to your RentRedi subscription. This will cost an extra $15-$99/month, depending on the number of units you have.

Rentec Direct

Winner: Best Rental Property Tax Prep Tools

- Designed to address the needs of DIY landlords as well as property management companies, Rentec Direct includes all the tools necessary to manage and rent your properties.

- Full general ledger accounting for properties, tenants, and owners.

- An extremely robust reporting system to track and manage your portfolio performance.

- Online rent payments are automatically tracked and recorded into your software.

- Strength: Complete Solution

Rentec Direct includes all the tools for landlords to manage and rent your properties. This property management software includes your own custom rentals website, a complete accounting system, tenant screening, free online rent payments, online file management, and more.

In our opinion, Rentec Direct is the rental property accounting software with the best tax preparation tools. Easy to manage tax reporting features in Rentec Direct make finding the information you need at tax time right at your fingertips.

Income and Expense Tracking: Rentec Direct features full general ledger accounting for every property, tenant, owner, and bank account. Therefore, bills and fees can be automatically generated and charged to tenants. Also, recurring transactions can be sent to owners automatically.

Bank Integration: Landlords can connect their Rentec Direct accounts with operating accounts to track and record business transactions from their bank. As a result, this maintains the integrity of accounting ledgers and saves time by automating data entry and reconciliation. You can also synchronize all your financial data with QuickBooks without having to re-enter the same data multiple times. Simply export any ledger or report from Rentec Direct into QuickBooks.

Reporting: Landlords have access to a robust reporting system with Rentec Direct. Specialized reports for property portfolios and owner statements provide you the most relevant data quickly and easily. All reports can be emailed, printed, or exported to PDF or Excel. Additionally, all your data can be synchronized with QuickBooks to provide a familiar format to your CPA or bookkeeper.

Tax Preparation: Rentec Direct provides full functionality for IRS 1099-MISC e-file and IRS Schedule E tax reporting. The 1099 Tax Assistant assists landlords with the necessary information to easily compile 1099 tax forms for the IRS, vendors, and owners. Because data is retrieved directly from the Rentec Direct accounting tools, error-free transmission is ensured.

The following reports helps find and organize all the data you need come tax time:

- 1099 Tax Assistant: Provides a list of all vendors paid during the timeframe with option to limit to those above $600 annually.

- Depreciation Schedule: Shows all depreciable improvements for the selected year.

- Schedule E Assistant: Provides an income/expense statement based on items which populate to your Federal Schedule E.

Rentec Direct also provides full e-file functionality with the IRS and will mail paper copies to the recipients as necessary.

Cost: Rentec Direct’s “Rentec Pro” subscription starts at $35/month for up to 10 units, with prices increasing after that. Currently, the first 2 weeks are free with a new subscription.

Bonus – CAM Allocation: Common Area Maintenance is included with a Rentec PM subscription. Simply enter the percentage or fixed allocation of common expenses for each tenant. Then the software will automatically calculate their portion and invoice them directly for their share.

Get started with Rentec Direct by taking advantage of a free two-week trial.

Reporting and Accounting Tools: Best Specialty Options

The following reporting and accounting tools also offer interesting features we think you might like based on your own needs. For instance, landlords who require an integrated banking option can consider Baselane or Azibo, while Avail is an excellent choice for an all-around full-featured software product. Similarly, if you require more of a hybrid property management approach, Hemlane can help offload some of your commitment.

Avail

Best All-Around Property Management Platform

- Handle your property accounting in the same platform used to manage your rentals.

- Increase visibility into all property-related transactions.

- Track the performance of your rentals and prepare for tax season.

- Strength: Complete Solution

Avail has been one of our favorite property management software products, and now they have recently introduced new rental property accounting features. You can track your rental property income and expenses to streamline the accounting process. Additionally, rent payments and maintenance costs are automatically uploaded to your accounting dashboard to make it easier to see how much money is coming in and out.

Income and Expense Tracking: Avail will automatically sync payments and maintenance expenses logged through the platform straight into your dashboard. You can also add one-time transactions collected outside of Avail to keep your income and expense tracking up to date.

Bank Integration: Collect rent with Avail and deposits into your bank account are automatically logged in your dashboard. Avail automatically syncs collected payments, maintenance costs, and other transactions without manual input.

Reporting: See if you’re paying more in expenses than what you’re generating in rent payments. Analyze the performance of each rental based on money coming in and money coming out.

Tax Preparation: Track your property accounting according to IRS standards with categories and transaction types. Your transactions can be viewed through your dashboard or exported into a spreadsheet to share with your tax professionals. This spreadsheet can be filtered by the rental property, transaction type, vendor or payer, and more.

Cost: Avail has two subscription plans: $0 for Unlimited or $7/month per unit for Unlimited Plus for premium features such as next-day rent payments, custom lease agreements, no ACH fees, and more.

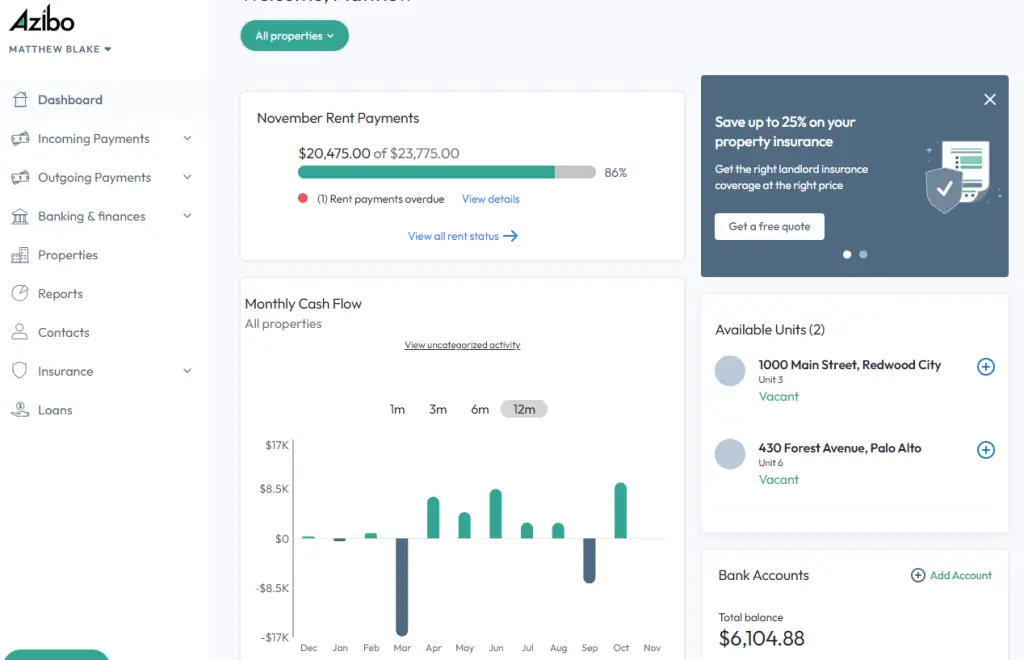

Azibo

Simple and Compliant Accounting, Built for Rental Property Owners

- Azibo’s core features are free to use, with optional additional services that can be purchased.

- Built in partnership with real estate CPAs, you get built-in tagging, categories, metrics, and reports for your rental business

- Accounting and financial services are built into Azibo’s property management platform.

- Save time and reduce stress when your expenses and income are already sorted and categorized.

- Strength: Complete Solution

Azibo is an easy-to-use rental property management tool that allows you to receive online rental applications, screen tenants, collect rent (credit card, ACH, or debit card payments), and manage accounting with rental-focused tax prep tools and reporting. Along with all these features, it also offers a landlord-centric bank account with zero monthly fees.

Azibo offers a full suite of accounting and financial management features which, unlike QuickBooks, were developed specifically for landlords and property managers. To do this, they joined forces with Brandon Hall (known as The Real Estate CPA) to improve the rental property bookkeeping experience for independent landlords. Together, they built a rental property accounting software solution from the ground up to help landlords ensure compliance, save money and time, and eliminate common tax errors. Features include:

- Send and schedule payments via ACH, paper checks, or wires

- Tag & split transactions with 120 pre-built tags

- Real-time reporting with multiple pre-built reports available for immediate use

- Landlord-specific tax packet available for easy tax document preparation

- Unlimited amount of LLC’s under one account

Income and Expense Tracking: Categorize inflows and outflows with tax categories and property assignments as you go. Your expenses and income are already sorted and categorized from over 200 transaction tags already set out of the box.

Bank Integration: With accounting and financial services built into Azibo’s property management platform, integration is seamless.

Reporting: You can quickly track and reconcile your cash flow, income, and expenses in real-time. See properties that are paid up and any renters you need to follow up with.

Tax Preparation: You will save time and reduce stress when your expenses and income are already sorted and categorized. Just download your documents and hand them off to your CPA.

Cost: Azibo is free for landlords, and accounting is available at no extra cost.

Baselane

Best Integrated Rental Property Accounting and Landlord Banking

- Integrated set of property management tools to help real estate investors and landlords save time and money while increasing their rental property returns.

- Tax reporting simplified.

- All your finances in one place.

- Real time cash flow and performance tracking.

- Strength: Landlord Banking

Baselane is a rental property management tool that helps landlords and real estate investors save time and money while increasing their rental property returns.

Along with having one of the best bank account options for landlords, Baselane offers seamless integration with either a Baselane bank account or your existing ones. You can also integrate it with your bookkeeping, reporting, analytics, and rent collection tools.

Income and Expense Tracking: Say goodbye to spreadsheets with one simple, consolidated ledger

for all your transactions. Save countless hours each month through automation and have all your finances in one place.

Bank Integration: Seamless integration with your existing bank accounts, or open

a Baselane banking account built for landlords.

Reporting: Get automated insights into your property performance, from net cash flow to core real estate metrics, including cap rate, ROE, and cash-on-cash return.

Tax Preparation: Baselane offers auto-generated tax reports and Schedule E to share with your accountant, at the click of a button.

Cost: Baselane is 100% free with no hidden fees.

Baselane is currently offering a $150 bonus. Get started in minutes:

DoorLoop

Best QuickBooks Integration

- Powerful and easy-to-use property management software to help manage and grow your portfolio from anywhere.

- Send all your income and expense transactions to QuickBooks Online in real time with one click.

- Reduce human error, make taxes easier, and save time with one-click reports, bank sync, and automatic payments.

- Get 50% off your first two months. Includes unlimited training, support & migration

- Strength: Complete Solution

DoorLoop is a powerful all-in-one property management software that is easy to use and stands out from many of the other options on the market. It offers unlimited support, full-scale accounting functionality, and a complete suite of useful features from listing, leasing, rent collection, maintenance, tenant communication and more. This is a fantastic option for landlords and property managers looking to streamline their workloads, save time, and grow their business.

DoorLoop integrates with QuickBooks online, allowing you to sync all of your data from the former to the latter in just one click. Data is mapped as closely as possible between DoorLoop and QuickBooks in order to make data entry and updates as seamless as possible.

DoorLoop also offers a full suite of accounting features which, unlike QuickBooks, were developed specifically for landlords and property managers. The software’s built-in features include:

- Real-time reporting (with custom reports as well as over 60 built-in, best-practice-abiding templates)

- A customizable chart of accounts

- Bank sync

- Transaction reconciliation

- One-click data exports to Excel or your printer

Income and Expense Tracking: Update all of your transactions as they happen and edit them anytime. Add online rent collection and stay on top of every deposit, withdrawal, and transfer so that no expense or income goes unnoticed.

Bank Integration: Powered by Plaid, bank sync allows you to integrate your bank account, credit card, or debit card with DoorLoop so that you can easily categorize and reconcile transactions for your properties. This allows you reconcile transactions automatically and avoid having entire reports ruined by a typo or miscategorization, making sure everything is categorized correctly and perfectly aligned.

Reporting: Customize your chart of accounts and reports to your needs, or choose from over 60 built-in, best practice templates to see how your business is doing.

Tax Preparation: Keep your accountants happy and make tax season a breeze by exporting any report to Excel or syncing with QuickBooks. You can also and invite your accountant into DoorLoop where they can access all the reports they need for free.

Cost: DoorLoop offers three subscription tiers, starting at $49 per month, each with the option to be paid monthly or annually. DoorLoop is currently offering 50% off your first two months and includes unlimited training, support & migration.

Sign up for a demo of DoorLoop and get 50% off your first two months.

Hemlane

Best Hybrid Property Management Platform

- Hemlane is a next-gen property management tool that bridges the gap between DIY and full service property management.

- 3 packages: Basic, Essential, and Complete, starting at $28 per month + $2 per unit, so you can decide how much service you require from Hemlane

- Any transaction paid through Hemlane’s system is automatically recorded to reduce manual entry.

- Strength: Hybrid Full-Service Mgmt

Hemlane is a property management platform that helps property owners manage their rentals wherever they are. It is a cross between DIY and full service management that automates day-to-day administration, from advertising vacant properties to collecting rent and late fees. Hemlane offers a flexible and transparent solution for rental owners, landlords, and real estate investors.

For landlords who want complete freedom from the daily operations of their rentals, Hemlane can help you connect with local, in-person leasing agents and 24/7 repair coordination with local service professionals. You can also choose to maintain 100% control and automation with Hemlane’s all-in-one online platform for leasing and management. Or select something in between where you have access to Hemlane’s software plus repair coordination to allow you to sleep through the night without being woken up with a late night emergency. Hemlane also offers on-demand, add-on leasing or pre-eviction services.

Income and Expense Tracking: Hemlane tracks income and expenses from online payments and manual entries. You can also upload documents and receipts for any transaction. Categorize expenses using Hemlane’s default subcategories or create your own custom list and descriptions. Sort and view all income and expenses or on an individual property level. You can filter for active, complete, in transit, or incomplete transactions as well.

Bank Integration: Hemlane supports multiple bank accounts for deposit for your portfolio of investments. Add as many bank accounts as you would like, without any additional fees.

Reporting: Through your landlord dashboard, you can view Cash Flow, Income Statements, or Lease Ledger reports for all or just individual properties. You can customize reporting periods and download Excel or PDF versions.

Tax Preparation: Since the 2020 tax year, payments to non-employees (independent contractors) must be reported to the IRS and provided to the vendor on form 1099-NEC. Hemlane does not file or create the 1099-NEC for you. However, as long as you run your transactions through their platform, these payments are covered by form 1099-K, which they do send where applicable and required by the IRS.

Cost: Hemlane’s “Basic” plan starts at $30 month for a single unit. Landlords maintain 100% control of their properties using Hemlane’s platform for leasing and management, including income and expense tracking and other financial and reporting capabilities. Hemlane also offers additional packages where they can handle 24/7 repair coordination or even day-to-day management of your property starting at $40/month. Or delegate your entire day-to-day operations to Hemlane for as low as $60/month.

Choosing the Best Accounting Software For Landlords: What to Consider

These are the key reporting and accounting features we considered when determining our top accounting software recommendations. We also include a bonus feature that some landlords may find useful. When looking for the reporting and accounting software that is best suited for you, take a look at how each service handles the following tasks.

Income and Expense Tracking:

Most of these software solutions track all online rent receipts automatically. Additionally, with many of them, landlords can input their expenses, whether they were paid online or not.

If the software allows it, you can categorize these expenses and assign them to individual properties or units. This is good for reporting at any given time to see if your business is operating efficiently and profitably. Or if not, to see where expenses can be managed.

Bank Account Integration:

With most property management software platforms, landlords can link their bank accounts to receive incoming rent payments. This makes it convenient and quick to receive rent. Most also have created safe and secure payment systems so you and your tenant’s data will not be compromised.

Some of the products also allow landlords to sync the bank account transactions with their systems. This makes reconciliation with bank statements and recorded checks a thing of the past.

![]() Also Read: Landlord Banking: What is the Best Bank Account for Landlords?

Also Read: Landlord Banking: What is the Best Bank Account for Landlords?

Reporting:

Generating reports help you understand the finances of your rental property business and where there are opportunities for improvement. You should consider the quantity and quality of reports that landlords can run from their property management software.

Tax Preparation:

Especially useful with some of the products we looked at are accounting tools that help with tax preparation. These include the ability to create 1099s for contractors you have paid as well as helping complete the federal Schedule E tax form.

![]() Also Read: 8 Rental Property Tax Deductions Landlords Need to Know

Also Read: 8 Rental Property Tax Deductions Landlords Need to Know

Cost:

While there are several free options available, some charge subscription fees or make money in other ways.

Bonus – Common Area Maintenance Allocation:

Common Area Maintenance (CAM) charges are shared expenses that tenants pay for. These charges are commonly found in commercial leases, though some residential and mixed-use properties have similar arrangements. Common examples include trash pickup, snow removal fees, landscaping, and water/sewer.

If this is relevant to your properties, consider the software products that give landlords a way to allocate maintenance costs for common areas to individual tenants. These calculations can get complicated, so having a built-in method to calculate fees creates a fair and transparent way to assign costs.

Accounting Software for Landlords Frequently Asked Questions:

Property management accounting allows property owners and landlords to track income and expenses from their rental properties. By tracking, categorizing, and organizing rent payments, deposits, late fees, other income, as well as maintenance expenses, repair costs, owner payouts, and more, you’re able to ensure that all of your books are accurate and up-to-date.

This allows landlords to better monitor performance of their portfolio and make better, informed decisions about their properties. It also makes tax preparation easier by exporting all of your accounting data in just one click.![]() Also Read: The Rental Property Accounting Guide for Landlords

Also Read: The Rental Property Accounting Guide for Landlords

Property management accounting can be complex and time-consuming for many landlords. It also might be the most critical function, as having correct, or incorrect, financial information can affect every decision a landlord makes, including rent pricing, maintenance, improvements, and more.

Fortunately, accounting software for landlords exists. The best rental property accounting tools help landlords ensure their financial information is accurate, up-to-date, efficient, easily accessible, and tax-compliant.

Yes! There are property management software products designed for landlords and property managers. Some focus specifically on financial tracking, reporting, and accounting, with ledgers and categories geared towards accounting for rental property. Others also handle online rent payments, tenant screening, advertising, and leases so you can keep all of your property management and accounting tools in one place.

Many landlords use QuickBooks to track their rental property finances. There are pros and cons with using QuickBooks. As an accounting tool, QuickBooks is great because you can create and send invoices, receive payments, track income and expenses, and run reports. Additionally, it integrates with common software programs like TurboTax.

However, QuickBooks is purely an accounting tool, and it has its limitations. For example, it does not have the ability to collect rent payments, manage maintenance tasks, or provide lease templates and electronic signing. In other words, QuickBooks is not specifically accounting software for landlords.![]() Also Read: Rental Property Spreadsheets: Should Landlords Use Excel or Property Management Software?

Also Read: Rental Property Spreadsheets: Should Landlords Use Excel or Property Management Software?

Takeaway: The Best Accounting Software for Landlords

There are many reporting accounting tools that you can use either in addition, or as an alternative to QuickBooks for rental properties. The benefit of using any of these property management software products is that they have been specifically designed for landlords and property managers. As a result, they offer the features and reports you need. Selecting the best one for you and your properties depends on the features you require. Whatever the case, accounting for rental property becomes significantly easier with dedicated rental property accounting software for landlords. We encourage you to try some or all of the accounting tools recommended here.

Disclosure: Some of the links in this post are affiliate links and Landlord Gurus may earn a commission. Our mission remains to provide valuable resources and information that helps landlords manage their rental properties efficiently and profitably. We link to these companies and their products because of their quality, not because of the commission.

4 thoughts on “Reporting and Accounting Tools: Best Accounting Software for Landlords”